Module 2: URLA Form 1003

In a mortgage transaction, pre-qualification is an initial step where a potential borrower provides certain documentation to a lender to assess their eligibility for a mortgage loan. While the specific documents requested may vary based on the lender's requirements and the borrower's circumstances, there are common documents typically requested during the pre-qualification process. The Uniform Residential Loan Application (URLA) and the documents needed to verify the information therein are covered in this module.

URLA: Form 1003 – Section1: Borrower Information

This section asks about the applicant’s personal information.

Context: Identifying the document.

Title: Section 1: Borrower Information

Key takeaways: Important information.

Borrower name, social security number, date of birth, and citizenship status

Type of credit requested

Marital status and number of dependents

Residence history. The application must cover the last 2 years

Supporting documents:

Borrower identification

Social security card

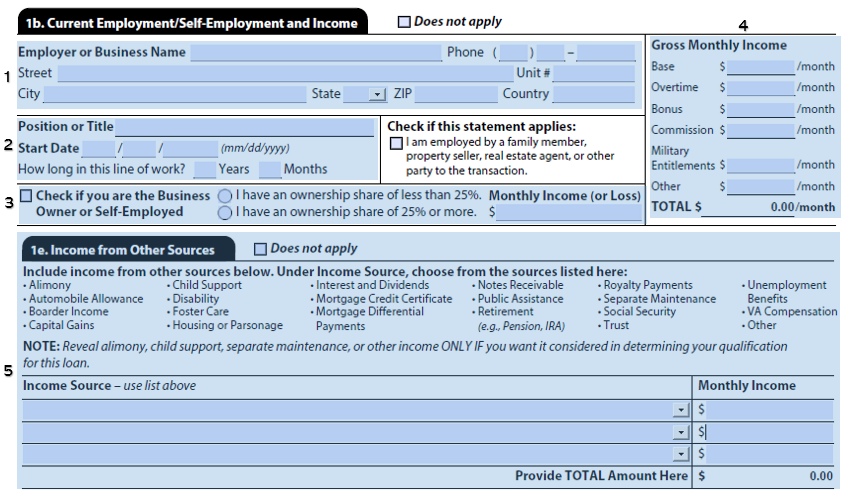

URLA: Form 1003 – Section 1b: Current Employment/Self-Employment and Income & Section 1c. Income from Other Sources

This section asks the applicant about income from employment and other sources, such as retirement, that they want considered to qualify for the loan.

Key takeaways: Important information.

Employer name and address

Employee title and start date

Self-employed checkbox

Income breakdown

Income from other sources

* The application must cover the last 2 years of employment history.

Supporting documents for employees:

Written verification of employment

Pay stubs

W-2s (as required by AUS)

Supporting documents for self-employed borrowers:

1099s (if any)

Tax returns (as required by AUS)

Tax transcripts (as required by AUS)

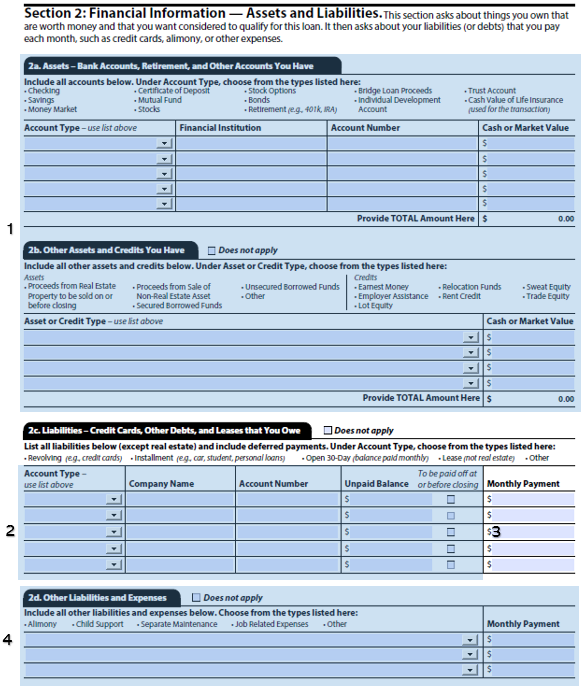

URLA: Form 1003 – Section 2: Financial Information — Assets and Liabilities

This section asks about things applicants own that are worth money and that they want considered to qualify for the loan. It then asks about liabilities (or debts) that are paid each month, such as credit cards, alimony, or other expenses.

Key takeaways: Important information.

Assets and other assets/credits breakdown. Read the 1003 for information of what is considered an asset and another asset.

Liabilities breakdown. In Encompass, liabilities are imported directly from the credit report.

Unpaid balance and payoff checkbox

Other liabilities breakdown

Supporting documents for assets:

Bank statements

Investment account reports

* Liabilities are supported by the credit report or credit supplements. Other liabilities (§2d) are supported by divorce decrees, mutual agreements, or court orders.

URLA: Form 1003 – Section 3: Financial Information — Real Estate

This section asks the applicant to list all the properties they currently own and what is owed on them. In a refinance transaction, this section should also include the property to be refinanced.

Key takeaways: Important information.

Real estate owned (REO) complete address

Property value

Status

Intended occupancy

Monthly expenses and income

Current mortgage loans on the property

Supporting documents:

Mortgage statement (if there is a current mortgage on the property)

Property tax bill (if tax is not escrowed, or there is no mortgage)

Property insurance (if insurance is not escrowed, or there is no mortgage)

Homeowner’s association (HOA) statement or borrower letter of explanation (LOE) stating there is no HOA

Lease agreement and proof of rental income (if the property will be retained, intended occupancy is investment, and the applicant will use rental income)

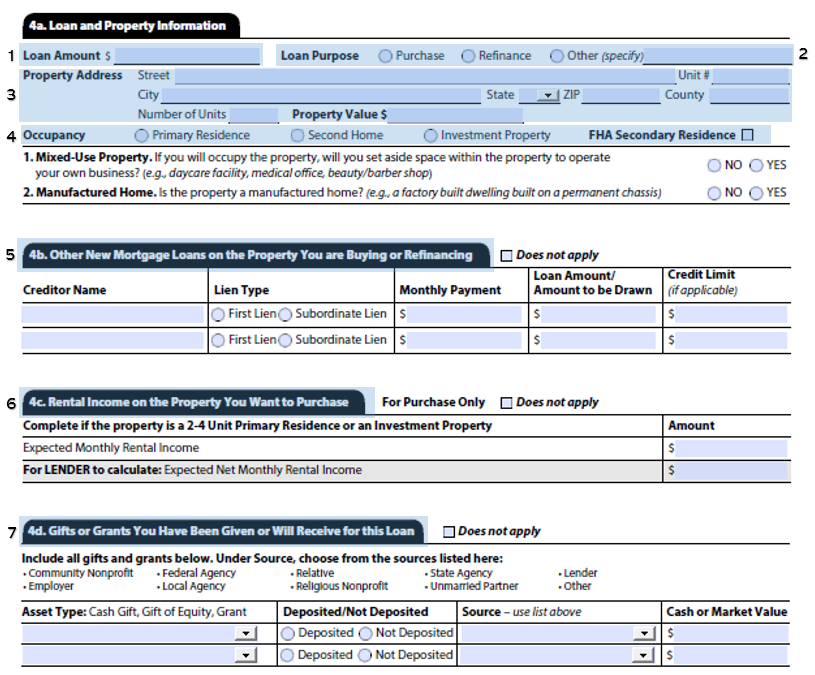

URLA: Form 1003 – Section 4: Loan and Property Information

This section asks about the loan’s purpose and the property to be purchased or refinanced.

Key takeaways: Important information.

Loan amount

Loan purpose

Subject property address and estimated value

Occupancy

Additional mortgages on the subject property

Rental income on subject property to be purchased

Intended gifts to be received by the applicant to aid closing costs

URLA: Form 1003 – Sections 5–9

Section 5: Declarations asks specific questions about the property, the funding to be applied for, and the applicant’s past financial history.

Section 6: Acknowledgements and Agreements tells the applicant about their legal obligations when they sign the application.

Section 7: Military Service asks questions about the applicant (or their deceased spouse’s) military service.

Section 8: Demographic Information asks about the applicant’s ethnicity, sex, and race.

Section 9: Loan Originator Information is to be completed by the Loan Originator (LO).

Key takeaways: All the information on sections 5–9 must be completely filled out.