Module 2: Section 1 - Borrower Information

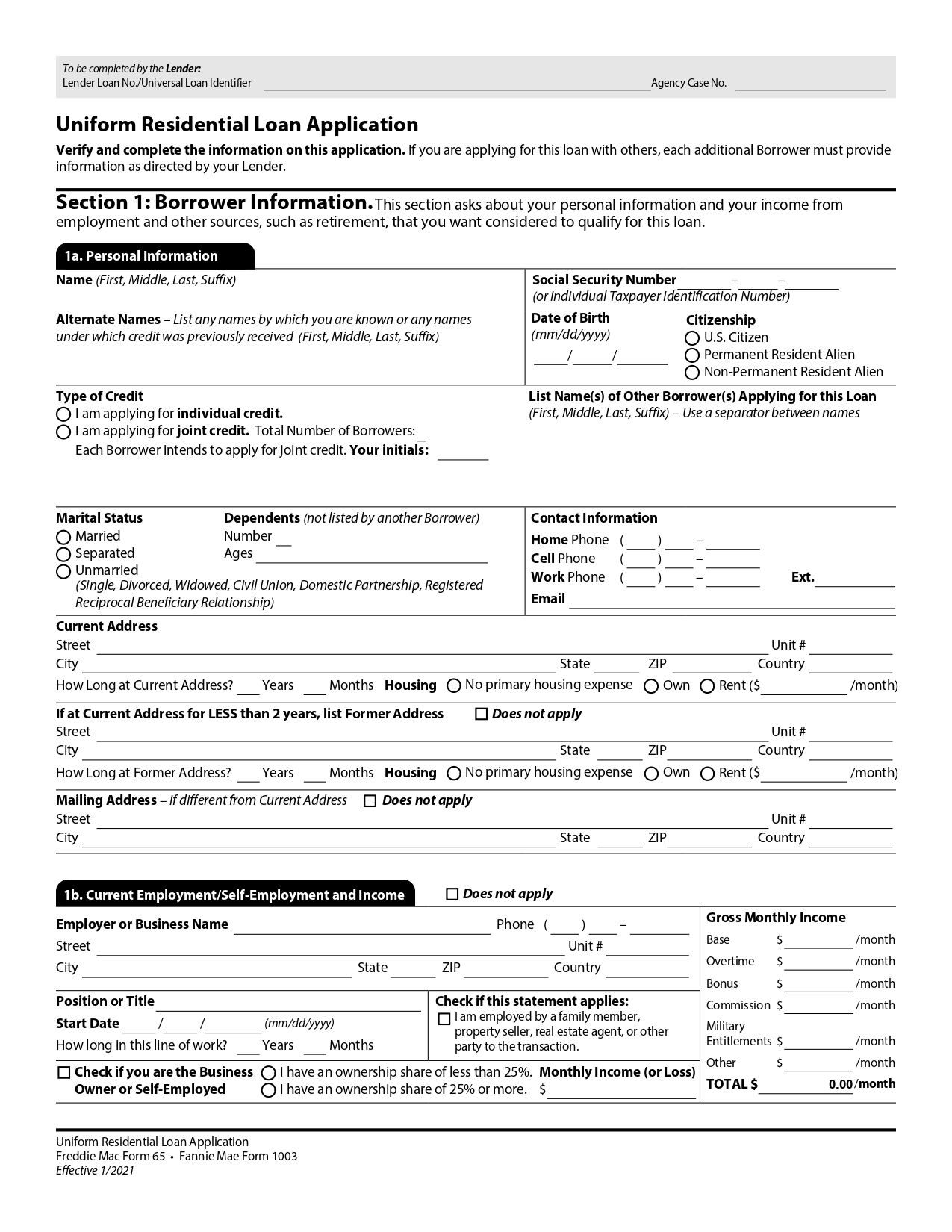

Section 1: Borrower Information of the URLA Form 1003 is the first section of the form and asks for basic information about the borrower, such as their name, address, Social Security number, and date of birth. This information is used by lenders to identify the borrower and to verify their identity.

Section 1 is divided into the following sub-sections:

1a. Personal Information

1b. Current Employment/Self-Employment and Income

1c. Additional Employment/Self-Employment and Income

1d. Complete Information for Previous Employment/Self-Employment and Income

1e. Income from Other Sources

In section 1a. Personal Information, applicants must fill out the following:

Applicant’s name and alternate names.

Alternate names are other names that may have been used by applicants for credit previously received. Alternate names may be aliases or variations on their name. The name on the application must match the name on the applicant’s government-issued photo identification.

Applicant’s social security number.

If the applicant has an ITIN number and no social security number, the ITIN number can be used instead of the social security number. The social security number must match the Social Security Administration’s (SSA) card. Other numbers, such as the ITIN number, must match their corresponding documentation.

Applicant’s date of birth

The date of birth must match the date of birth on the applicant’s government-issued photo identification.

Applicant’s citizenship status

Some programs may only be available for applicants with a specific citizenship status.

Type of credit

Whether it’s an individual credit or a joint credit. If it’s a joint credit, the names of the other applicants must be written on this space.

Applicant’s marital status and number and ages of dependants

Applicant’s contact information.

Applicant’s residential history

Current address and former addresses to cover the last 2 years (at minimum)

In section 1b. Current Employment/Self-Employment and Income, applicants must fill out the following:

Employer or business name, phone, and address

Verified by a third-party source like 411.com.

Applicant’s position or title

The position or title will be verified by the lender during the verification of employment.

Applicant’s start date and time in the line of work

The start date (and end date, for previous employment/self-employment and income) will be verified by the lender during the verification of employment.

Statement if employed by a bias or interested party to the transaction

This could include a family member, property seller, real estate agent, or other party to the transaction. If yes, the lender may request additional documentation per program guidelines.

Statement if the borrower is a business owner or self-employed

If so, their ownership share and monthly income/loss. This information will be verified by the lender using tax documentation or other documents.

The applicant’s gross monthly income (if not self-employed or a business owner)

The gross monthly income will be broken down and may be verified by the lender during the verification of employment and must match the supporting income documentation.

In section 1c. Additional Employment/Self-Employment and Income, applicants must fill out the following:

If the applicant has additional, current wage employment or self-employment this section needs to be completed.

In section 1d. Complete Information for Previous Employment/Self-Employment and Income, applicants must fill out the following:

The application must always have complete information covering the last 2 years of employment history. If the borrower’s current employment does not cover 2 years, the previous employment would be input here.

In section 1e. Income from Other Sources, applicants must list other sources of income and the monthly income from those sources. Examples of other income sources are listed in this section.