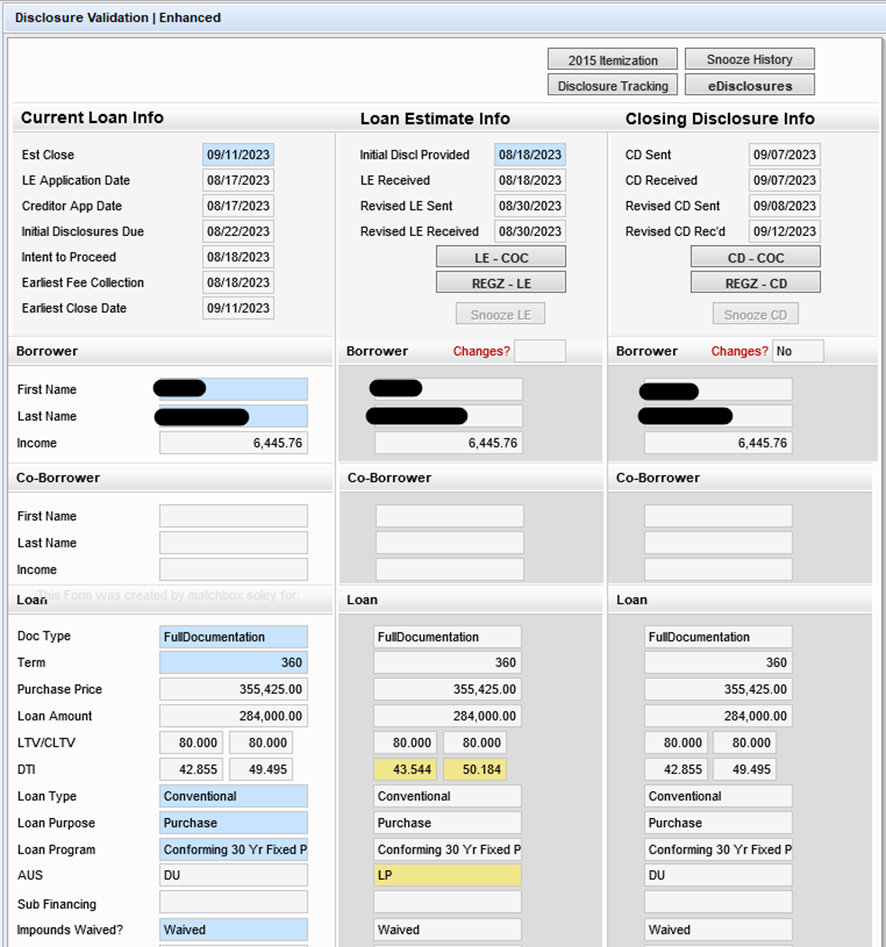

Encompass: Disclosure Validation Form

Access the Disclosure Validation form in Encompass by going to Forms > Disclosure Validation || Enhanced in the lower left corner of the screen.

You can also check the “Show in Alpha Order” and “Show All” checkboxes at the bottom of the left-hand panel to list all available Encompass forms in alphabetical order to make it easier to find specific forms.

The Disclosure Validation form can be used to see key loan details and easily compare current loan information to the one that was issued in the latest Loan Estimate and Closing Disclosures. This form also highlights differences in loan details for you.

At the top of the Disclosure Validation form you can find four quick access buttons to the following screens in Encompass:

2015 Itemization

Snooze History

Disclosure Tracking

eDisclosures

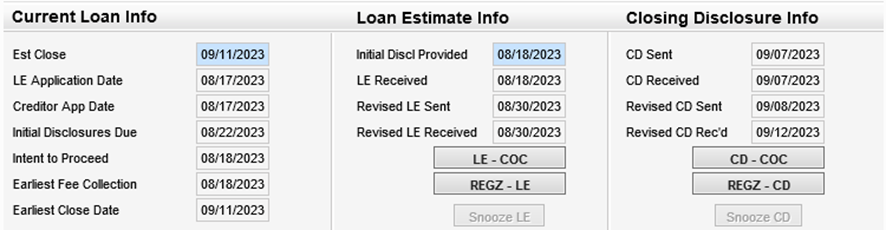

The Disclosure Validation form is divided into three columns, each with its own header:

Current Loan Info

Loan Estimate Info

Closing Disclosure Info

Each column gives you a view of important key dates and also includes a quick access button to the Loan Estimate and Closing Disclosure’s respective Change of Circumstance (COC) and REGZ screens.

Each info column is divided into the following sections:

Borrower section with borrower’s name and income

Co-borrower section (if there are any co-borrowers in the application) with co-borrower’s name and income

Loan section, including—

Loan term, rate, and amortization

Purchase price and loan amount

LTV/CLTV and DTI

Loan type, purpose, and program

AUS

Impounds

Property section with property address, appraised value, units, occupancy, type, HOI, taxes, and HOA dues.

Closing Costs Summary section, including seller credits.

Discrepancies between current loan, loan estimate, and closing disclosures information will be highlighted in this screen for ease of readability. These discrepancies can be reviewed in part to determine if a Change of Circumstance (COC) is necessary.