Processing CD Change of Circumstance

Closing Disclosure (CD) Change of Circumstance

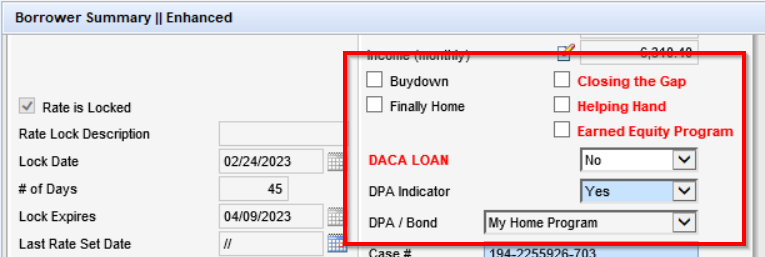

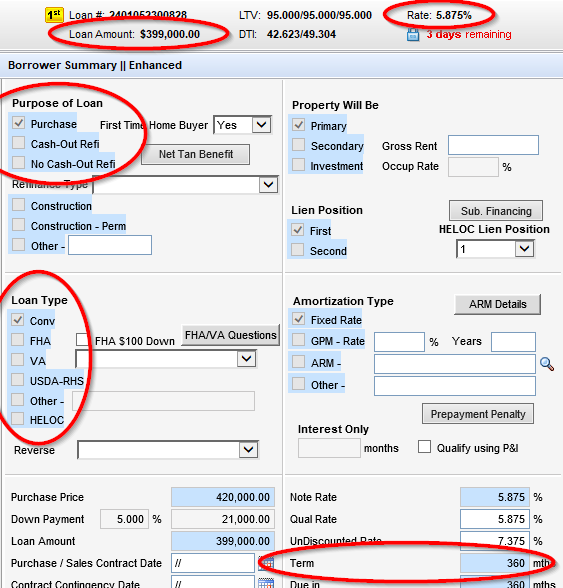

Check what type of Loan Program we are using in the “Borrower Summary II Enhanced” screen. In addition to the “Loan Program” field, check the indicator boxes.

Check to see if there is subordinate financing. If there is, you will need to send a Revised CD/COC for both files.

If the loan program name has “DPA” in it, there’s subordinate financing

Check the VOAL screen, if there is a lien/file, there’s subordinate financing

If the LTV/CLTV/HCLTV are different numbers, there’s subordinate financing

CD Page 1

Review the Changed Circumstance and Comments to make sure all the appropriate Reasons are checked.

If this is selected…

Additional service (such as survey) is necessary based on title report

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Appraised value is different than estimated value

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Borrower income could not be verified or was verified at different amount

Then this Reason should be checked…

Changed Circumstance - Eligibility

If this is selected…

Borrower request change

Then this Reason should be checked…

If this is selected, notify your manager

If this is selected…

Change in loan amount

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Change in PMI, UFMIP, VA Funding Fee or USDA Guarantee Fee

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Change in purchase price

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Final Inspection (1004D) Required

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Loan type or loan program has changed

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Locked Loan

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Other

Then this Reason should be checked…

If this is selected, notify your manager

If this is selected…

Pricing Change

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Rate lock extension

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Recording fee are increased based on need to record additional unanticipated documents such as release of prior lien

Then this Reason should be checked…

Change in Settlement Charges

Alerts & Messages

See if there is a “Good Faith Fee Variance” flag. The Changed Circumstance/Comment/Reason in the “Closing Disclosure Page 1” page should correspond with any variance. If they do not, review these with your manager.

If there are any Cost to Cures, make a note in the Milestone Comments as to what caused the Cost to Cure

Alerts

If there is a “Redisclose Closing Disclosure (APR, Product, Prepay)” alert, see if the APR went up by more than 0.125%. If it did, the Reason box “Change in APR” should be checked in “Closing Disclosure Page 1.” If the APR went down, you do not need to mark a box.

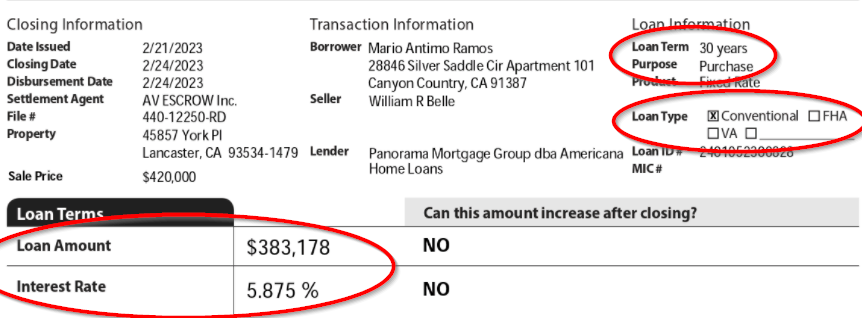

Last CD: Compare the terms on the last CD to current data in file

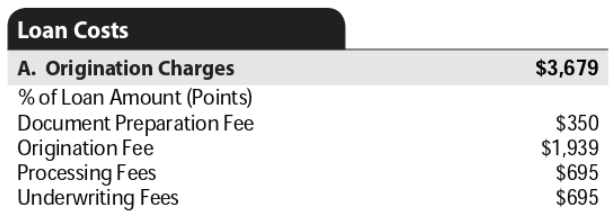

Check/compare the Origination, Processing Fee, Underwriting Fees, Document Preparation Fees and Program Specific Fees. These should be the same.

2015 Itemization vs Title Draft CD/Settlement Statement

If the Lien Position shows “2nd” delete all fees and skip the remaining steps for this section

800. Items Payable in Connection with Loan - These should match the amount on the last LE:

Loan Origination Fees (see DPA & Specialty Fee Chart if applicable)

Processing Fees

Underwriting Fees

Document Preparation Fees

Appraisal Fee – Review the amount on the Invoice and whether it has been paid already. Open the Fee Details icon next to the Appraisal Fee in Encompass. The amount in Encompass/ALINA should either match or be higher than the amount on the Invoice (it should not be lower). Make sure the (POC) Paid Outside of Closing amount matches the amount already paid.

Do not change these fees:

Credit Report (not required for Finally Home or Equity First)

Tax Service

Flood Certification

Verification of Employment (not required for Finally Home or Equity First)

Attorney’s Fee – Texas only

Compliance Review Fee

Condo Desk Review Fee (for Condos only)

Condo Certification Fee (for Condos only)

Reinspection Fee

Program-specific fees (see DPA & Specialty Fee Chart if applicable)

Origination Points (Discount Points) - Make sure the Bona Fide box is checked.

Line 802e Origination/Discount Point – This number will equal 100 minus the Price on the Rate Sheet (not applicable for Finally Home or Equity First)

Example:

100 – 96.838 = 3.162

900. Items Required by Lender to be Paid in Advance

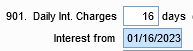

Daily Int. Charges – Make sure the date after “Interest from” is at least 3 business days from the date of the CD

Homeowner’s Ins. –The annual premium on the HOI Policy/Invoice/Quote should be within pennies of the amount in Encompass

1000. Reserves Deposited with Lender

Aggregate Setup

Cushion - Every state except Nevada should have 2 months of Cushion for Property Taxes and Hazard Insurance

Property Tax Due Dates – Reference the Tax Schedule excel sheet for the upcoming due dates

Hazard Insurance - This date should reflect the date after the Expiration Date on the Homeowner’s Insurance Policy

Example:

Mortgage Insurance – If the loan requires MI, there needs to be 12 “1’s” starting with the first month after closing

FHA – Will always have MI

Conventional – Only required if LTV is above 80%

1100. Title Charges

2015 Settlement Service Provider List – This company name/address should be different from our actual settlement agent listed on the Title Draft CD. If it’s different, check the “Borrower did shop for” checkbox denoted by “B.”

Match the fees from the Title Draft CD

Note: If the Loan Amount on the Title Draft CD is the same or slightly higher than the Loan Amount in Encompass, you can update the fees. If the Loan Amount on the Title Draft CD is lower than the Loan Amount in Encompass, do NOT update the fees. Request an updated Title Draft CD from the branch.

Owner’s Title Insurance – Should be marked Seller Obligated

Endorsements – The total fee for all Endorsements can be lumped together. Examples:

1200. Government Recording and Transfer Charges

Recording Fee and Transfer Tax – Do not update these amounts

Verify the Seller Credit matches Purchase Contract

Arizona:

Missouri:

Nevada:

Texas:

If there are any Lender Credits, verify there is written/email approval from the LO

Compliance Review (under the Tools tab)

Click the Preview button

After it’s done running, click “Fee Details” and look for any fees in Red. For any fee in Red, go back to the 2015 Itemization screen and click/unclick the APR box.

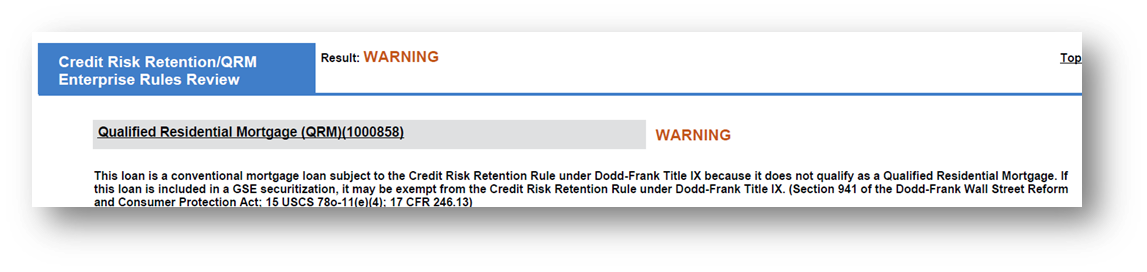

If there are any Warnings/Fails review with your supervisor

Exceptions:

If either of these Warnings pop up, ignore it. You can move forward.

If the Loan Program is FHA and it has Impounds, it does not have to pass this test:

For ITIN’s with FNBA, it only must pass the High Cost, NMLS and Licensing tests

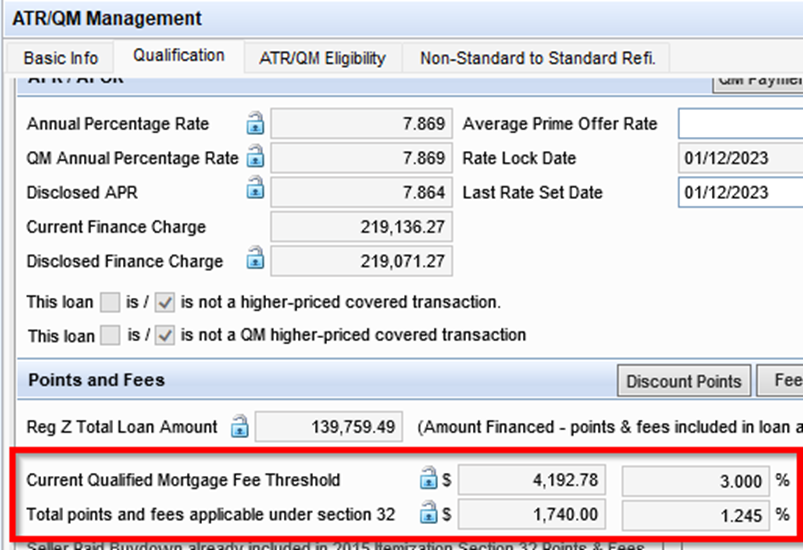

ATR/QM Management

The % in the “Total points and fees applicable under section 32” should be lower than the % above it in the “Current Qualified Mortgage Fee Thresholder” field. If it’s not, notify your manager.

REG-Z

Make sure to send to all borrower pairs