Initial Disclosures

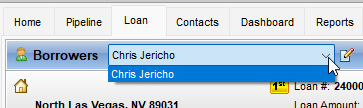

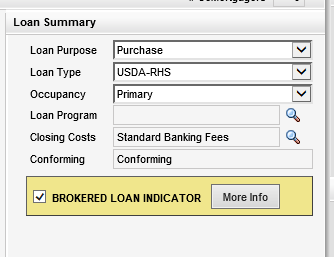

Verify how many Borrowers and Borrower Pairs need to be disclosed.

Check to see if all borrowers have already accepted eConsent in the Disclosure Tracking screen. If they have, the “eConsent Status” field will show “Accept.”

If they haven’t, send eConsent to each applicable borrower. To send eConsent:

Click on eFolder

Click on eConsent

Click on Continue

Then click Send Request

Verify the subject property address against USPS. Open a web browser, go to USPS.com, click on Quick Tools, select “Look Up a ZIP Code,” select the “Find by Address” option and enter in the Street Address, City and State (DO NOT enter the ZIP Code). Click Find. Verify the spelling of the address matches. PDF print the findings and place it in the eFolder.

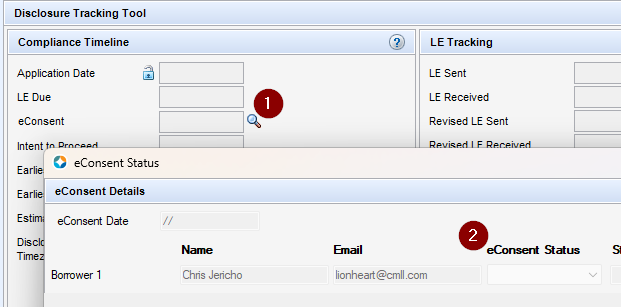

Check to see if the file requires a full Initial Disclosure package (Banked) or a skinny disclosure package (Brokered) based on the loan channel indicated in the Borrower Summary.

Go to Borrower Summary || Enhance and verify the channel

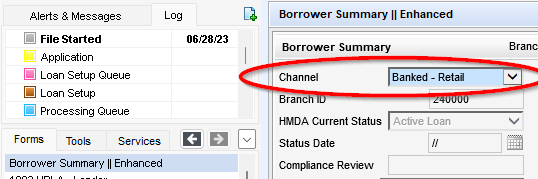

Still on the Borrower Summary || Enhance verify the Loan Program, Loan Purpose and Loan Type:

IF FHA loan you must have FHA MI- click GET MI.

IF Conventional loan OVER 80% you must have MI Quote to verify the final MI Factor / payment uploaded into eFolder.

Still on the same tab verify if its a DPA or Finally Home Indicator - Follow inst on fees (2015 itemization) for these programs.

On the 2015 Itemization, verify fees

800 Section

These fees should always show, sometimes they can be added together, make sure all fees are listed and review with LO appropriate fees.

Processing fees

Underwriting fees

Doc prep fee

Appraisal Fee (if applicable)

Credit Report Fee

Flood Certification Fee

Verification of Employment Fee

Compliance Fee (if applicable)

Condo Questionnaire

Condo desk Fee

Appraisal 1007 fee (if applicable)

Enginer Cert – For Manufactured homes

IBTS report – For Manufactured homes

900 Section

Daily interest charges

Mtg Ins. Premium (if applicable)

Verify correct VA funding fee (if applicable)

1000 Section

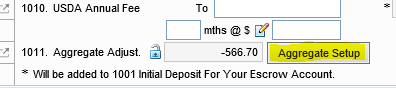

Input impounds into Aggregate Setup:

On this step you would need to click Aggregate Setup and then input the dates depending on the State. Also, you will have a section to add the Mortgage Insurance.

Example: The Tax column is to input the State tax, The Haz Ins is to input the date from one year in advance of the closing date, and Mtg Ins is where the Mortgage insurance dates go and add 12 ones after the first two months except in the state of NV.

Section 1100

Verify title/escrow fees match Smart fees cert

Section 1200

Verify Recording fees match Smart fees cert

Verify Transfer taxes

Section 1400

Verify Deposit matches contract

FACT Act Disclosure

Verify for each applicable borrower/borrower pair, mark the boxes "Material Terms of Credit Set by Credit Score" and "Credit Score Disclosure Notice" for each of the 3 credit bureaus listed

Loan Estimate Page 1

Input LE Date

Loan Estimate Page 2

Check the box "Use Actual Down Payment & Closing Costs Financed"

Input deposit amount (if applicable for purchases)

Loan Estimate Page 3

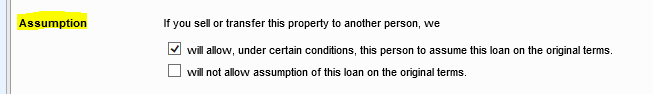

Assumption - FHA/VA loans mark the 1st box "Will allow…"

For Conventional loans, mark the 2nd box "Will not allow…"

Click "Get Late Fee" button to input correct late fees

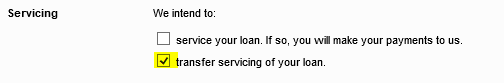

Servicing - check the 2nd box "transfer servicing of your loan"

RegZ - LE

Days Per Year - number of days should reflect 360 for conv loans, 365 for FHA/VA loans

Request for Transcript of Tax

Complete the request details for each borrower/ borrower pair:

First click on Default to TQL Rules,

Then on Tax Form is for,

lastly click on Copy from Borrower Summary.

Also make sure the IRS form is from Oct 2022.

Settlement Service Provider List

Verify Settlement and Escrow Services provider is listed

Verify Title Insurance provider is listed

Tools tab

Go to the Compliance tab and run compliance on the Preview tab.

After getting a Pass Mavent go to Fee Details and make sure that there is no red fees that need to be corrected.

Log (Milestones)

Click on the Application milestone and verify there are no missing fields