Module 3: Section 2 - Financial Information - Assets and Liabilities

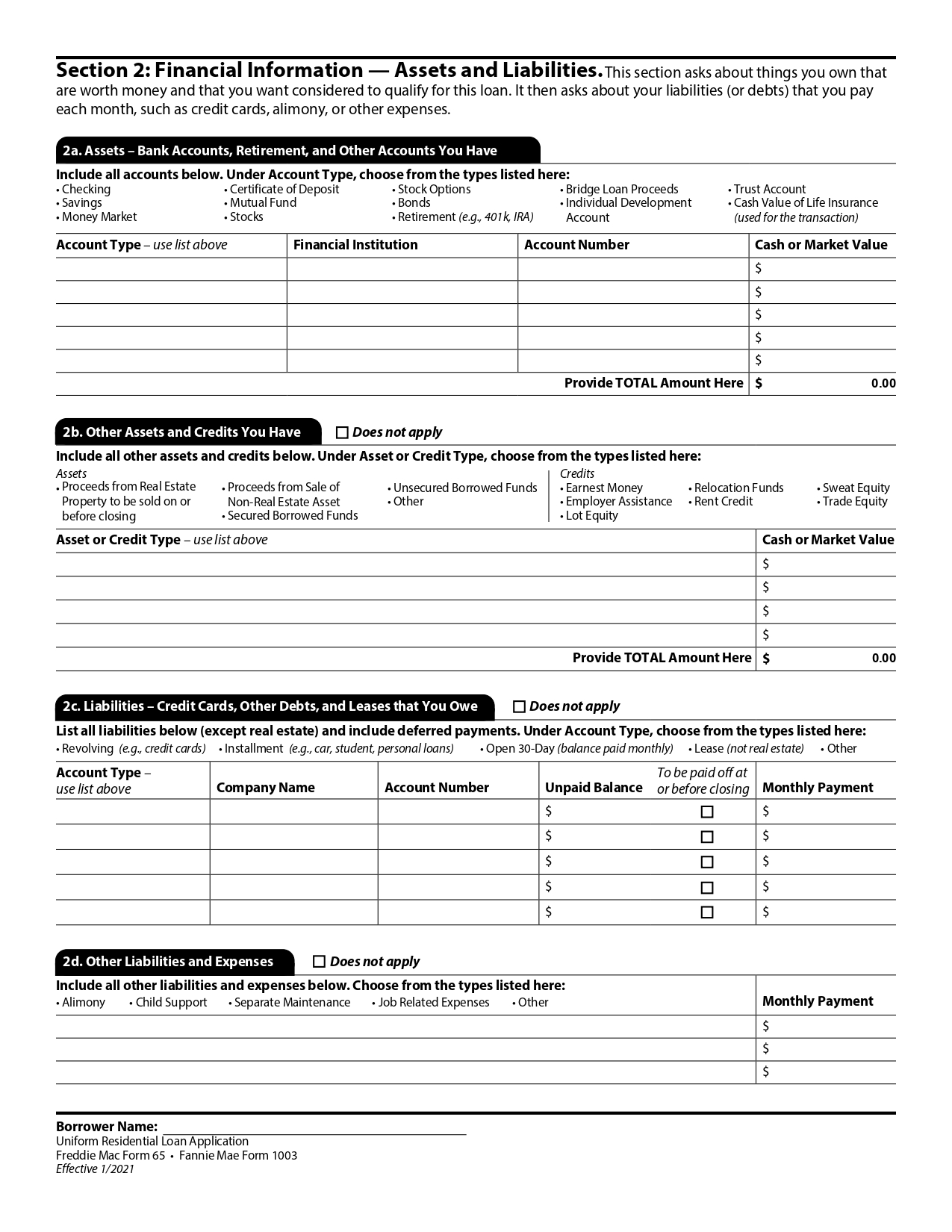

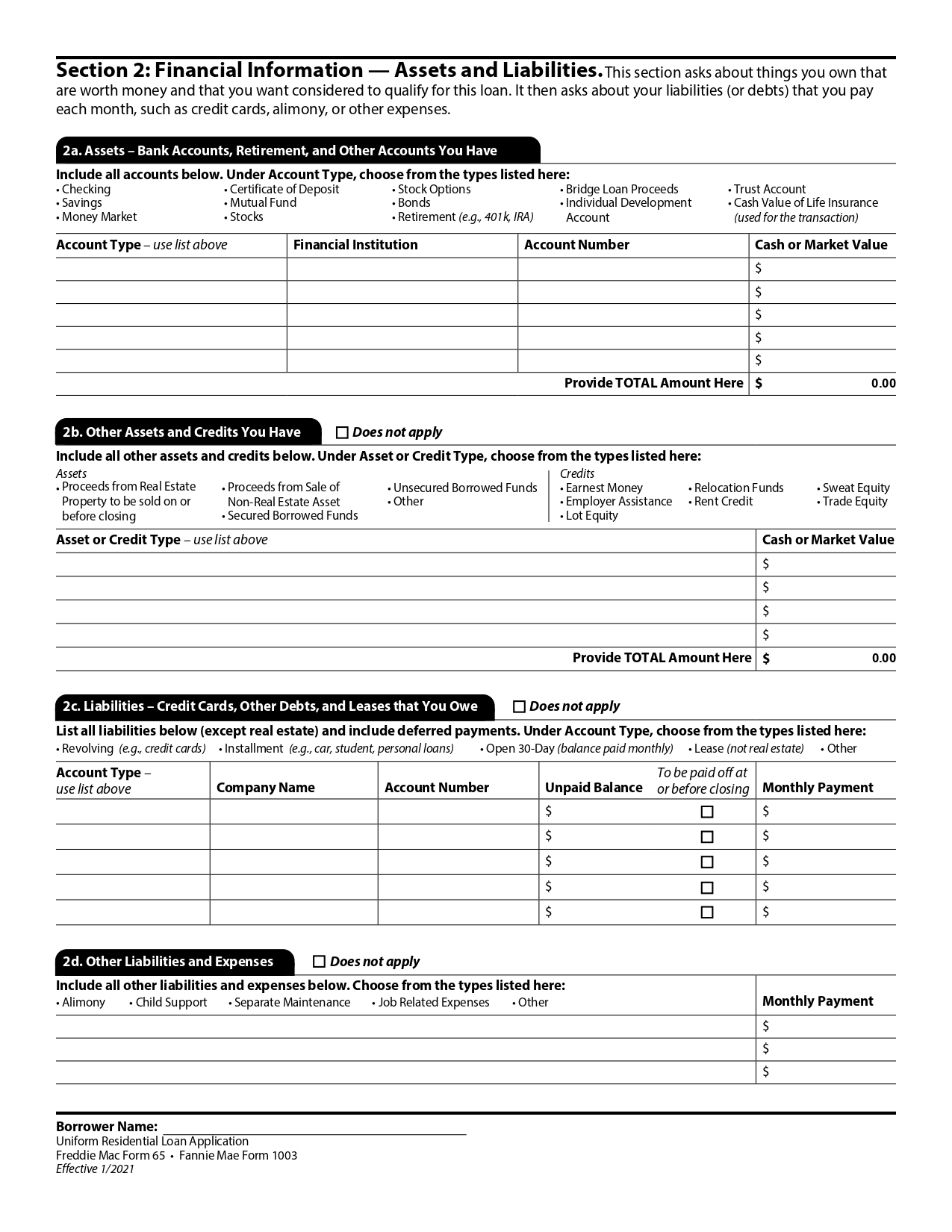

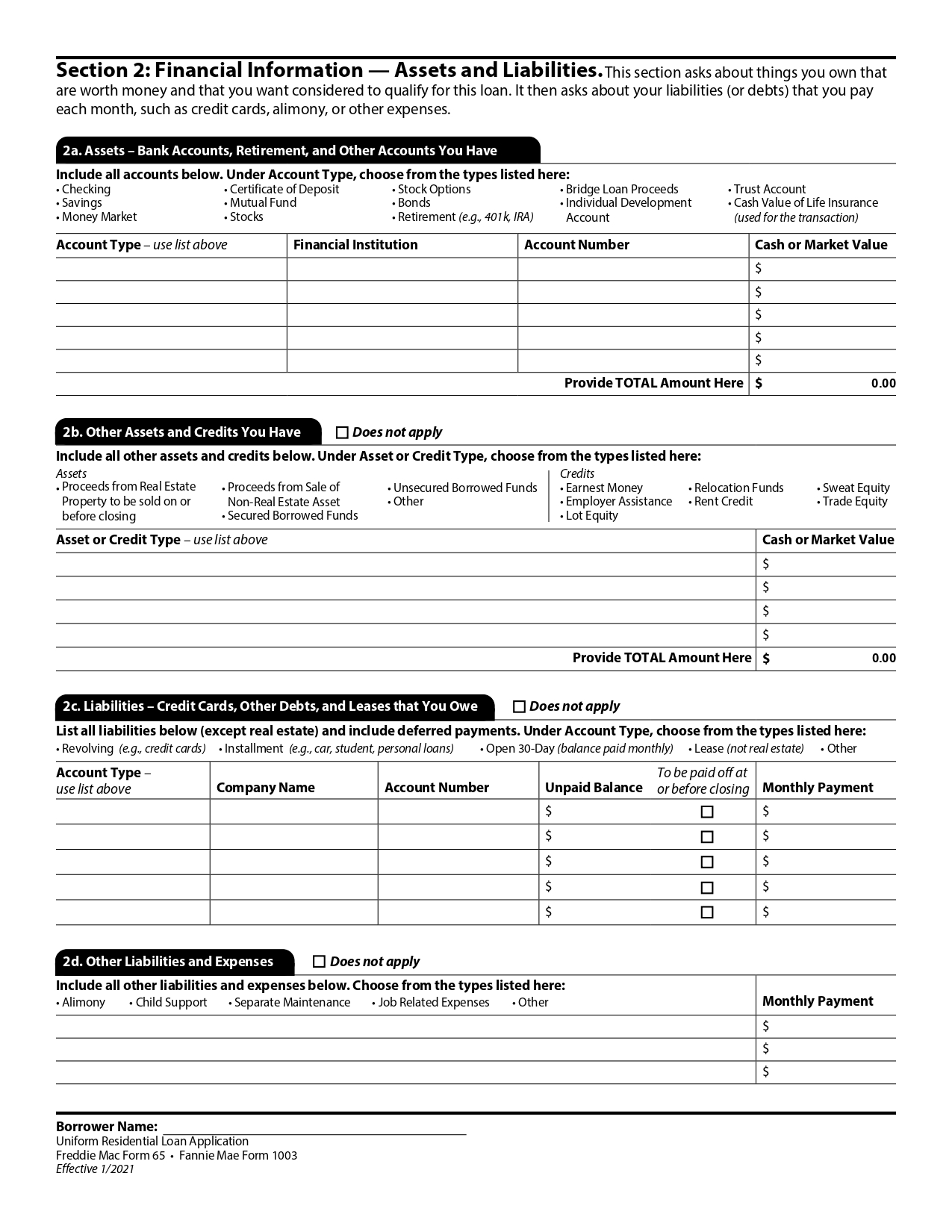

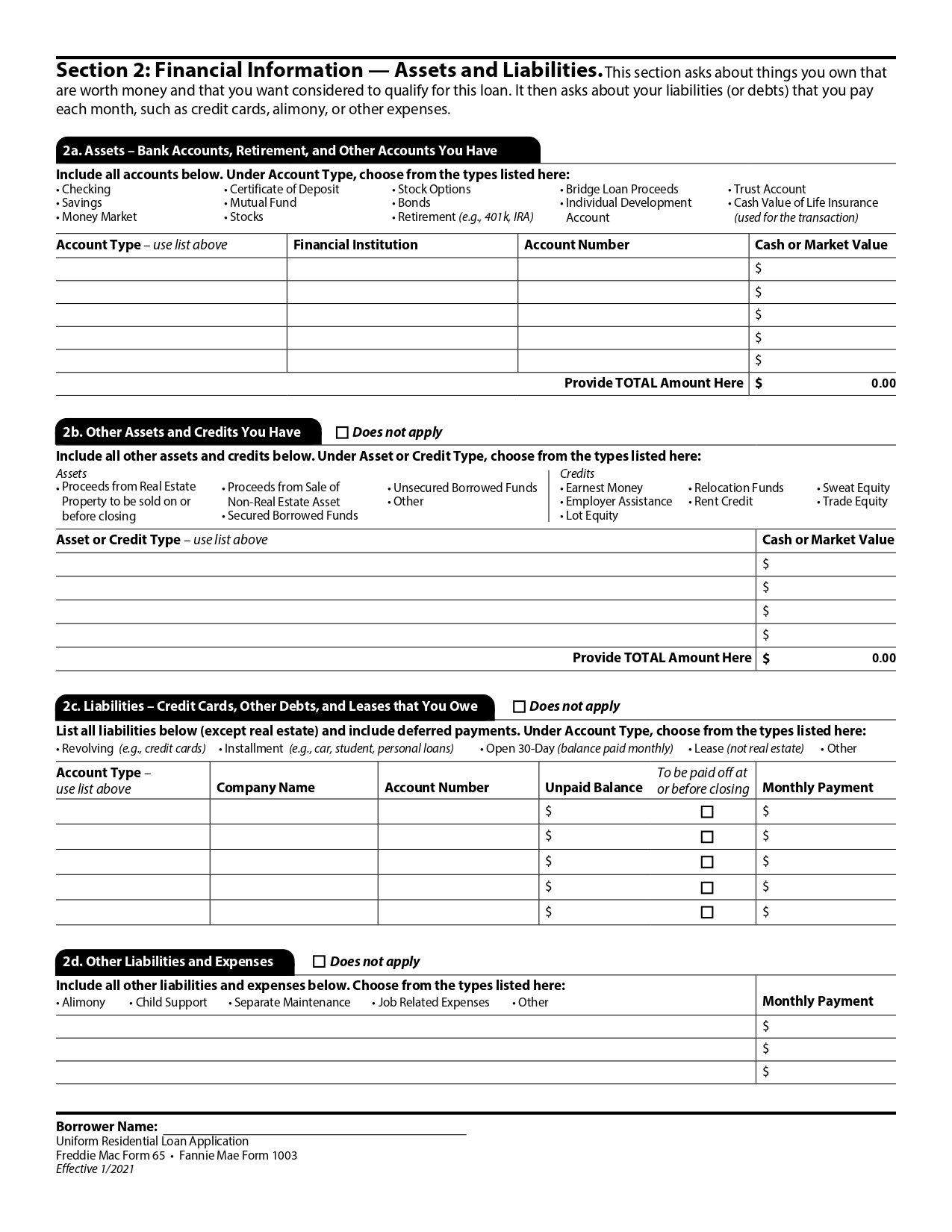

Section 2: Financial Information - Assets and Liabilities

Section 2: Financial Information - Assets and Liabilities asks for information about the borrower's assets and liabilities. This information is used by lenders to assess the borrower's ability to repay a mortgage loan.

Section 2 is divided into the following sub-sections:

2a. Assets – Bank Accounts, Retirement, and Other Accounts You Have

2b. Other Assets and Credits You Have

2c. Liabilities – Credit Cards, Other Debts, and Leases that You Owe

2d. Other Liabilities and Expenses

In section 2a. Assets – Bank Accounts, Retirement, and Other Accounts You Have, the applicant must enter information about each of their asset accounts. This information must include:

the current value of each account

name of the financial institution and

account number.

If they have received a gift or grant, and have deposited it in an account, include it in the Cash or Market Value amount for that account. Itemize each gift or grant (even if not yet deposited) in Section “4d. Gifts or Grants You May Have Been Given or Will Receive for this Loan.”

In section 2b. Other Assets and Credits You Have, applicant must enter information about other assets/credits not included in the accounts listed in Section 2a that the applicant would likely consider in qualifying for the loan. Credits the applicant will receive toward the property purchase are also listed here. (Note that gifts are not entered in this section but in Section 4d.)

Earnest Money

Enter this Credit Type and the Cash Value of the deposit submitted with a purchase offer to show that your offer is being made in good faith. Do not enter this credit if the amount of the earnest money is included in an asset account in 2a (for example, in the checking account from which the earnest money check will be drafted). (Earnest money is also known as a sales contract deposit).

Employer Assistance

Enter this Credit Type and the Cash Value of funds provided by an employer for the transaction. Do not enter this credit if the funds are already included in a depository account in 2a or entered as a relocation credit, a grant, or a subordinate lien on this transaction.

Lot Equity

Enter this Credit Type and the Market Value of the net equity in the lot (market value less any outstanding liens) for certain unique transactions. Generally, applies when you hold title to the land on which a manufactured home will be permanently attached.

Relocation Funds

Enter this Credit Type and the Cash Value of funds provided by an employer as part of a relocation package. Do not enter this credit if the funds are already included in a depository account in 2a or are entered as an employer assistance credit, grant, or subordinate lien on this transaction.

Rent Credit

Enter this Credit Type and the Market Value based on the portion of rental payments credited towards this transaction under a documented rental/purchase agreement.

Sweat Equity

Enter this Credit Type and the Cash or Market Value of materials provided for or labor performed on the property, by you or on your behalf, before closing.

Trade Equity

Enter this Credit Type and the Market Value of equity assigned to you if you will trade property with the seller as part of this transaction.

Does not apply

Select “Does not apply” and skip to Section 2c. Liabilities-Credit Cards, Other Debts, and Leases that You Owe if you do not have any other assets or credits.

The information on the accounts listed must match the applicant’s asset statements and other supporting documentation.

In section 2c Liabilities – Credit Cards, Other Debts, and Leases that You Owe, the applicant must

Enter the details of all personal debt that they now owe or will owe before this mortgage loan closes, including:

debts not listed on their credit report

debts with payments that are currently deferred, and

personal debts that will be paid off at or before closing, even if they will be paid off by this mortgage loan.

Do not include household expenses for phones, utilities, or insurance

Select “Does not apply” and skip to Section 2d. Other Liabilities and Expenses if they do not have any personal debt.

list all liabilities of the types listed in each section, and the monthly payment for each of them. Accounts listed in section 2c must also include the company name, account number, total unpaid balance, and whether the account will be paid off at or before closing.

In Encompass, the information in section 2c is imported directly from the credit report. The balance of accounts to be paid off at closing will be included in the cash to close calculation, and the lender must verify sufficient liquid assets to pay for those accounts at closing.

In section 2d Other Liabilities and Expenses, the applicant must:

List any alimony, child support, separate maintenance and certain job-related expenses.

Select “Does not apply” and skip to Section 3a. Property You Own if they do not have any other liabilities or expenses.