Borrower Summary

Borrower Summary || Enhanced

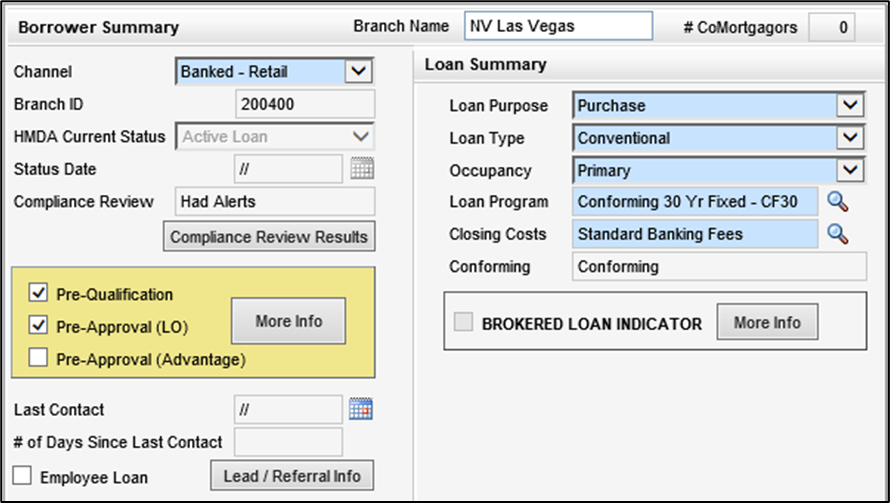

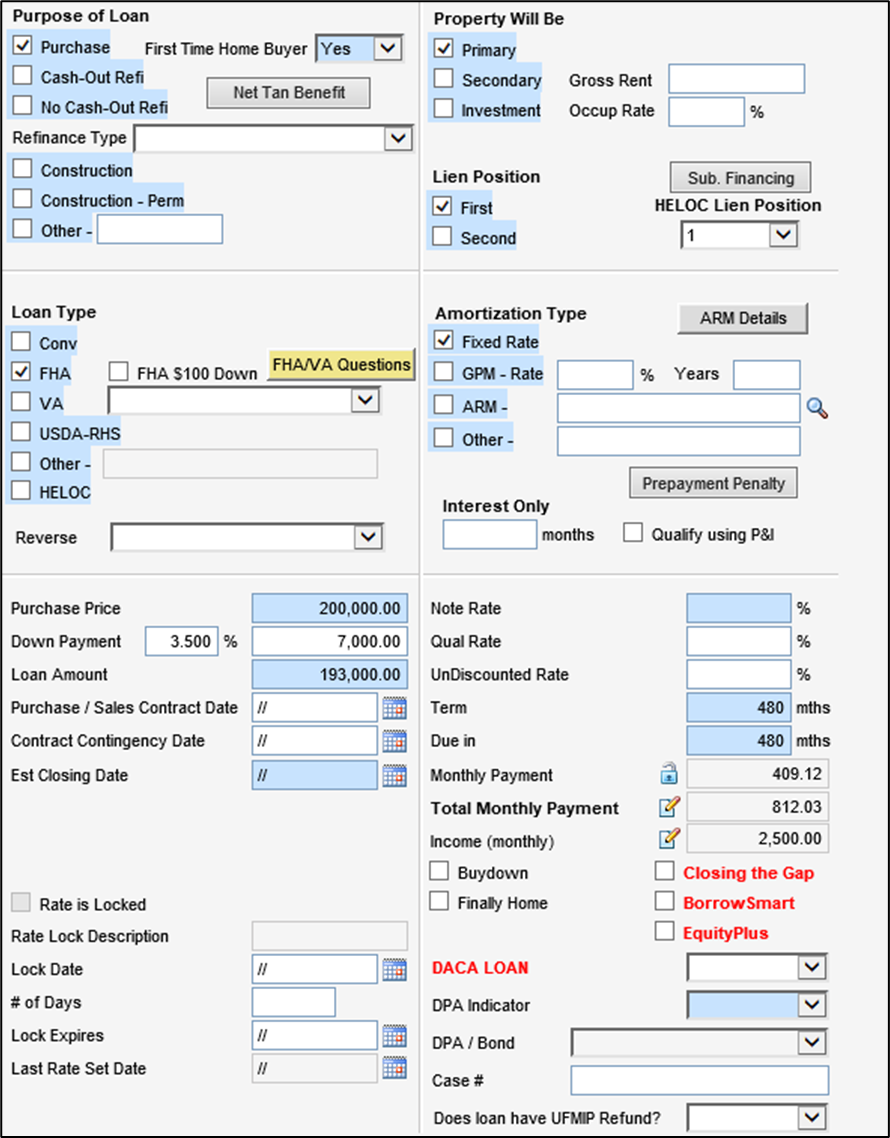

In the borrower summary form, make sure to fill out the loan purpose, type, occupancy, and loan program, as needed.

* Loan Purpose: Construction – Perm, No Cash-Out Refi, Purchase, Construction, Cash-Out Refi, Other

* Loan Type: Conventional, VA, FHA, Other, USDA-RHS, HELOC

* Occupancy: Primary, Secondary, Investment

Borrower Information must be completely filled out. Applicants with dependents must state dependents’ ages.

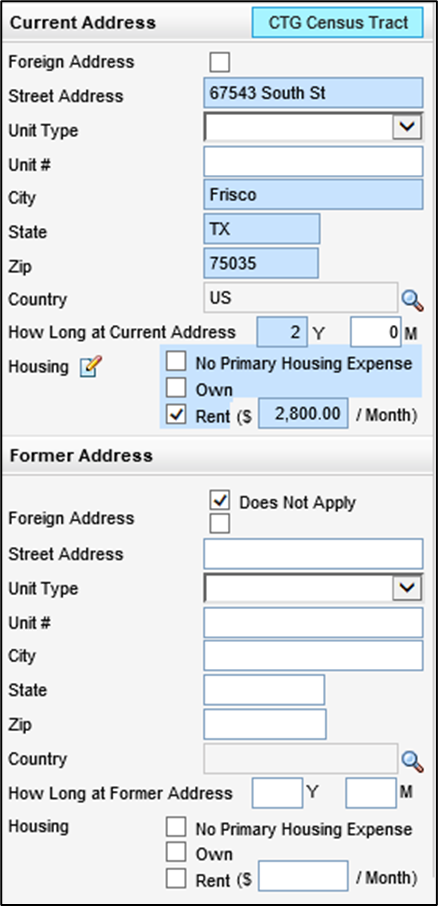

Complete the address information with 2 years history. The Borrower Summary form only has space for the 2 latest addresses.

If the applicant has lived in more than 2 residences in the last 2 years, go to Verifs > VOR or Forms > VOR to add additional previous addresses.

Rental expenses must be included for each residence within the last 2 years (that was rented).

If the applicant has no previous residences in the last 2 years, check the box Does Not Apply for former address.

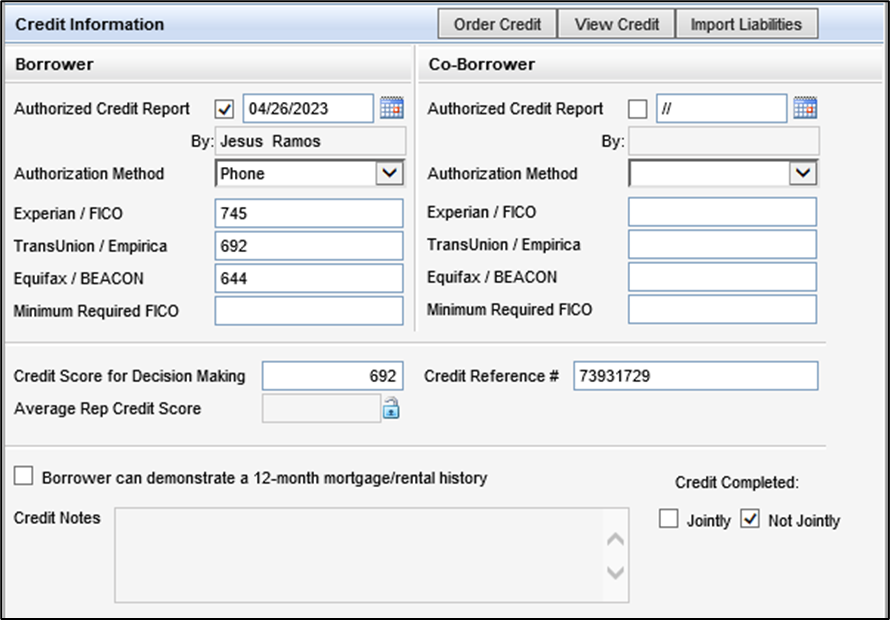

On the Credit Information section, make sure to Order Credit and then Import Liabilities.

On the Subject Property Information section, complete all possible information without unchecking the “TBD” checkbox.

* All information must be filled out except for Street Address (must remain TBD until escrow opens), Year Built, and eNotary.

* If the applicant already has an estate agent, their information can be quickly filled out via the Real Estate and Hazard Agents button without going into File Contacts.

Confirm that all information is correct on the Transaction Details section.

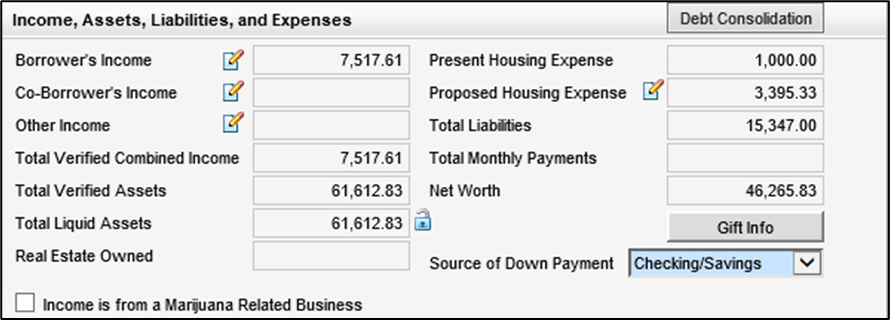

Select the Edit button for Proposed Housing Expense to open the Total Monthly Payment screen. Add Homeowner’s Insurance and Property Taxes. Select the Edit button for Mortgage Insurance to open the MIP Fee Calculation and select Get MI. Confirm the resulting MIP is calculated based on the loan term.

In the Income, Assets, Liabilities, and Expenses section, select the source of down payment.