Requesting Title and Escrow Docs

Requesting the Documents

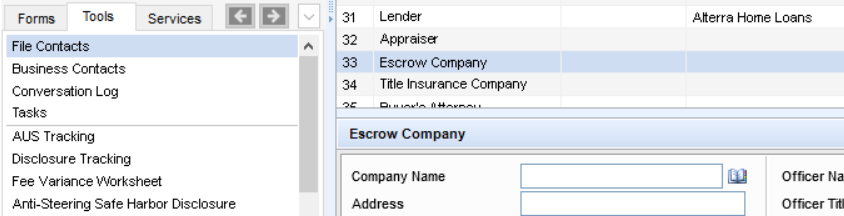

Determine who the Escrow Officer is.

For a purchase, this information should be in the Purchase Contract. If the info is not in there, check the Milestone Comments/File Contacts and if it’s not in either spot ask the Loan Officer.

For a refinance, reach out to your Loan Officer or Loan Officer Assistant to find out who they want to use.

Open a New Email in Outlook, enter the escrow officer’s email in the “To” line and type in a subject line that references the request/file (e.g. Request – Borrower Last Name / Subject Property Address / Loan Number).

Select the appropriate request template (samples can be found at the end of this Job Aid).

Update the template with the appropriate information specific to the file you’re working on (e.g. subject property address, borrower name, if you don’t need license numbers remove those, etc.).

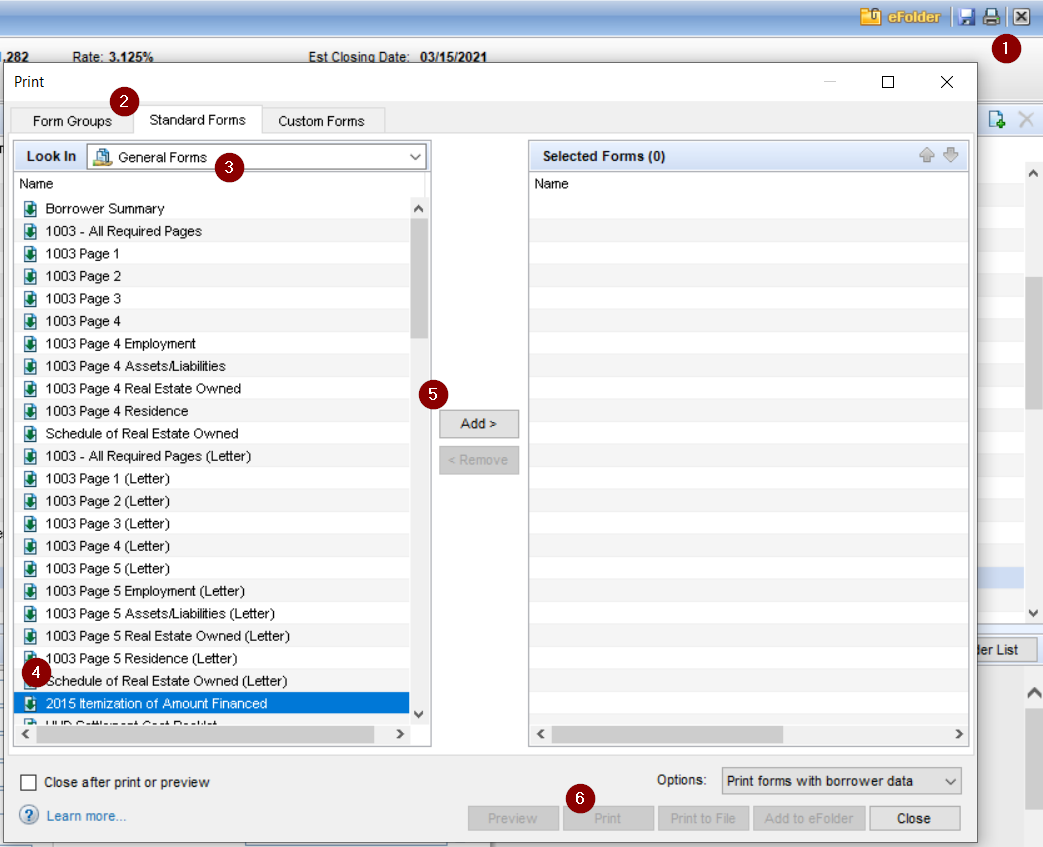

In Encompass, print the “2015 Itemization of Amount Financed” document and attach it to the email.

Send the email.

Once the documents are received: review, upload and file the documents:

Closing Protection Letter (CPL)

Place in the “Closing Protection Letter” placeholder

Subject Property Address

Borrower Name

Addressee/Mortgagee

Expires after 90 days

Earnest Money Deposit (EMD) Receipt

Place in the “EMD – Earnest Money Deposit” placeholder

Subject Property Address

Borrower Name

EMD Amount (should match “Cash Deposit on sales contract” amount in the Details of Transaction on page 3 of the 1003)

Who it came from

Plat Map

Place in the “Title Commitment” placeholder

Preliminary Title Report

Place in the “Title Commitment” placeholder

REVIEW/DATA INTEGRITY:

Subject Property Address

Borrower Name

Loan Amount/Proposed Policy Amount

UPDATE ENCOMPASS:

Escrow Case/File Number – Enter into the File Contacts

Escrow Officer – Add to the Escrow Company contact in the File Contacts through the Rolodex icon (CANNOT BE MANUALLY ADDED). Request vetting if needed.

Title Officer - Add to the Tile Insurance Company contact in the File Contacts through the Rolodex icon (CANNOT BE MANUALLY ADDED). Request vetting if needed.

For purchases, the Seller Name – Add to the Seller contact in the File Contacts

Expires after 90 days

Property Tax / Tax Cert.

Update the monthly proposed payment

If we are closing on Unimproved Property Taxes, make sure to obtain a Payment Shock Letter

Settlement Statement

Place in the “Title Draft CD (Title Fee Sheet)” placeholder

Subject Property Address

Borrower Name

Loan Amount

Update Escrow/Title in 2015 Itemization

Wiring Instructions

Escrow Company Name

Escrow Case/File Number

Sometimes escrow/title will send Wiring Instructions separately with a secure link. They may ask for the Escrow/File/Case Number. This can be found on the Prelim.

Purchase Request Template

Hello,

We are the lender for the buyer purchasing the property located at: PROPERTY ADDRESS

Please send the items below and advise if you need anything on our behalf. If needed we will send you a questionnaire that will come from our third-party vendor management company and is titled “Alterra Vendor Management Closing Agent Due Diligence Questionnaire.” Please be advised this must be completed as soon as received, this can delay closing/funding and Alterra issuing a CD and/or Docs.

Your License Number

Your company’s License Number

Preliminary Title Report to include: Property Address, 24-month Chain of Title, “Panorama Mortgage Group, LLC DBA Alterra Home Loans” listed as the Proposed Insured & Loan Amount

Plat Map

Tax Cert

Copy of Earnest Money Receipt & Copy of EMD check or Wire Details

Wire Instructions

Combined Settlement Statement to include our fees, title/escrow fees, closing costs, any seller contribution & EMD

Real Estate Agent Commissions

Transfer Tax even if paid by seller

Please include all HOA dues and HOA transfer fees (If applicable)

Please include the current tax installment if DUE

Please confirm the TOTAL sellers’ contribution towards the buyers closing costs

E&O Insurance for signing location

CPL to include: Proposed Insured, Complete Property Address, Borrowers name, Loan Amount, Loan # and Mortgagee Clause:

Panorama Mortgage Group, LLC DBA Alterra Home Loans

ISAOA/ATIMA

350 S. Rampart Blvd. #310

Las Vegas, NV 89145

Refinance Request Template

Hello,

We are the lender for the client refinancing the property located at: PROPERTY ADDRESS

Please send the items below and advise if you need anything on our behalf.

Preliminary Title Report to include: Property Address, 24-month Chain of Title, “Panorama Mortgage Group, LLC DBA Alterra Home Loans” listed as the Proposed Insured & Loan Amount

Plat Map

Tax Cert

Wire Instructions

Combined Settlement Statement to include our fees, title/escrow fees & closing costs

Please include the current tax installment if DUE

E&O Insurance for signing location

CPL to include: Proposed Insured, Complete Property Address, Borrowers name, Loan Amount, Loan # and Mortgagee Clause:

Panorama Mortgage Group, LLC DBA Alterra Home Loans

ISAOA/ATIMA

350 S. Rampart Blvd. #310

Las Vegas, NV 89145