Property: Preliminary Title Report / Title Commitment

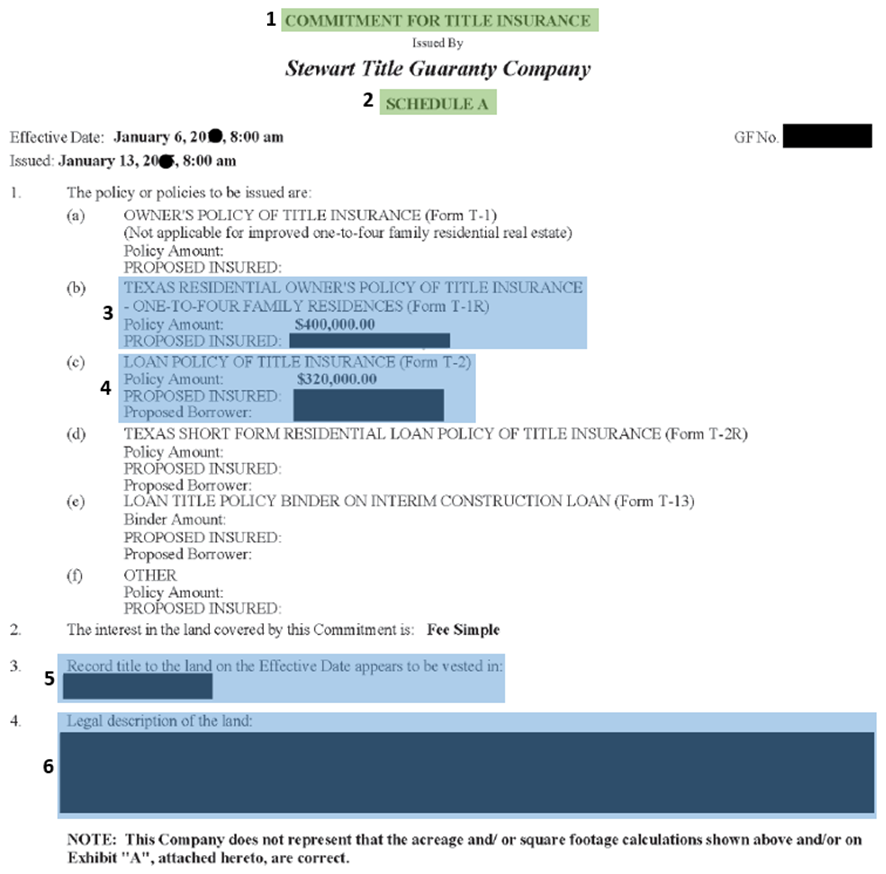

A preliminary title report, also known as title commitment, is a document that is prepared by a title company to provide information about the ownership of a property and any liens or encumbrances that may affect the title. Schedule A is the first part of a title commitment, which is a document that outlines the terms and conditions of a title insurance policy.

In Schedule A—

Context: Identifying the document.

Document title: Title Insurance Commitment, Preliminary Title Report, etc.

Schedule A title

Key takeaways: Important information.

Owner’s policy

Loan policy

Subject property current owner on record title

Subject property legal description

Notes on Schedule A:

Owner’s policy amount must match the purchase price. Proposed insured must match all borrowers.

Loan policy amount must match loan amount. Proposed insured must match company mortgagee clause (below).

Panorama Mortgage Group, LLC DBA Alterra Home Loans ISAOA/ATIMA 6623 Las Vegas Blvd South, Suite F-200 Las Vegas, Nevada 89119

Panorama Mortgage Group, LLC DBA Vision Mortgage Group ISAOA/ATIMA 6623 Las Vegas Blvd South, Suite F-200 Las Vegas, Nevada 89119

Panorama Mortgage Group, LLC DBA Loan Peak Lending ISAOA/ATIMA 6623 Las Vegas Blvd South, Suite F-200 Las Vegas, Nevada 89119

In Schedule B—

Context: Identifying the document.

Schedule B title

Key takeaways: Important information

Most recent year’s real estate taxes

Chain of title ≥24-months

Notes on Schedule B:

Chain of title might be found on a separate page.