1099

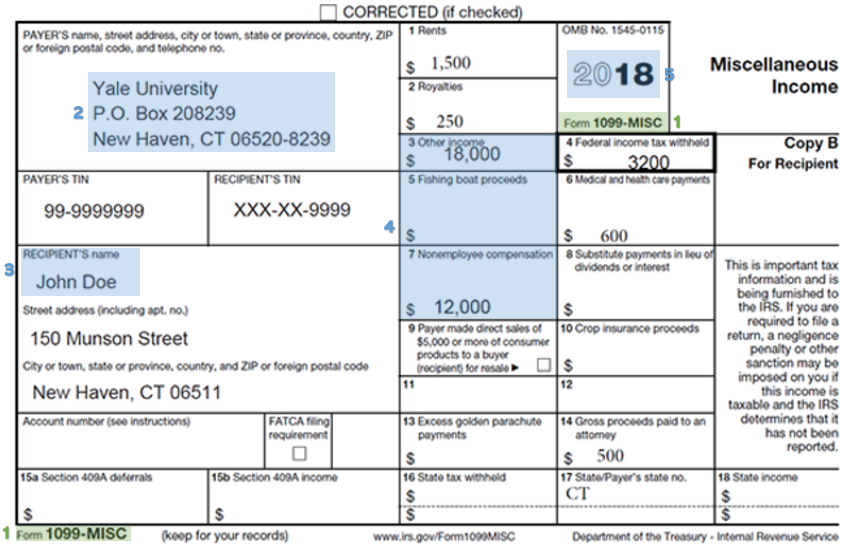

A 1099 form is a tax form used to report income received by individuals who are not employees, such as independent contractors, freelancers, or those who receive certain types of income. The form is provided by the payer to the recipient and also sent to the Internal Revenue Service (IRS).

Context: Identifying the document.

Document title

Key takeaways: Important information.

Payer’s name

Recipient’s name

Annual income

Year

Notes on income:

1099s are used to verify employment and income from prior years.

If a borrower worked with multiple companies in prior years, they would have multiple 1099s.