Closing Docs Process

File Prep

Verify key info with the Loan Officer, Loan Officer Assistant and Processor

Verify the date the borrower will be signing

Verify the date the loan should fund

Verify the borrower(s) desired vesting

Verify if there is a Re-Inspection we don't have an Invoice for yet

Verify the contact information for Escrow/Title

Review milestone comments for important information.

Confirm that all title and escrow/settlement agents and their companies are vetted

The entry in the File Contacts must include:

Full office address

Agent name

Phone number

Email address

Title/escrow case number

Navigate to the Secure Insight website (https://lender.secureinsight.com/) and ensure they are listed as Low Risk for Risk Rating

Verify if the borrower is using a Down Payment Assistance (DPA) program and if we have the DPA Closing Docs

If the loan program name contains the phase Down Payment Assistance (DPA), there’s subordinate financing

If the Combined Loan to Value (CLTV) is greater than the Loan to Value (LTV), there’s subordinate financing

Check the Verification of Additional Loans (VOAL) screen, if there is a line item, there’s subordinate financing

Separate docs will need to be pulled if using a DPA

Review and clear open Alerts

Review Alerts in the Alerts & Messages section. Start an email to condition/notify the appropriate party (i.e. underwriter, processor, Loan Officer) to clear Alerts:

Loan Officer to review

Lock expires

Underwriter to review

AUS Data Discrepancy Alert

Income: Paystubs expired

Title Report expired

Underwriting Fannie Mae DU expired

Underwriting Freddie Mac Loan Product Advisor expired

UW Docs Alert

Closing Docs Drawer to review

Closing Date Violation

Compliance Review – Review after reviewing fees

Disclosure Validation

Good Faith Fee Variance Violated – Review fees before issuing a Lender Credit for a Cost to Cure. If one is needed the cure amount, date and reason for the cure must noted in the Good Faith Fee Variance Resolution box.

Add cure to 1003 URLA – Lender

Make sure everything transferred over to page 1 of the CD and mark “tolerance cure”

Quality Control

Credit Refresh / Loan Quality Initiative (LQI)

This document is located in the LQI Report bucket/placeholder in the eFolder

Review and confirm Date Completed is within 10 days of the Note date.

Check the Received date in the bucket/placeholder. These dates should match to properly generate the expiration date.

Closing Protection Letter

This document is located in the Title Closing Protection Letter bucket/placeholder in the eFolder

The Date must be within 30 days of the Note date

Check the Received date in the bucket/placeholder. This date should match the date on the CPL to properly generate the expiration date.

Verify borrower’s name matches

Verify the property address matches

Verify the loan number matches

Review the mortgagee and confirm it references the DBA/brand

Alterra:

Americana:

SSA-89

This document is located in the SSA-89 Social Security Number Verification bucket/placeholder in the eFolder

Verify this form is in the eFolder and wet-signed

Underwriting Conditions

Locate the Underwriting Conditions tab in the eFolder

Sort by Status then Prior To

Click Status to have all Added conditions at the top

Review any Prior to Closing and Prior to Docs conditons that have a Status of Added and owner is marked as “CL” aka Closer

Verbal Verification of Employment (VVOE)

This document is located in the Income VOE Verbal bucket/placeholder in the eFolder

Confirm VVOEs are dated less than 10 days prior to the Note date for ALL borrowers

If the borrower is self-employed‐ confirm CPA letter/S.E. documents are dated less than 10 days prior to the Note date for ALL borrowers

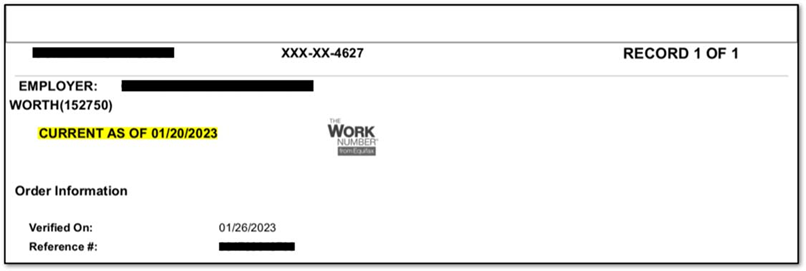

If using the Work Number, reference the “CURRENT AS OF” date not the Verified On date

Initial Closing Disclosure (ICD)/Loan Estimate (LE) review

The ICD must be sent & signed 3 business days prior to the Note date

Confirm all key information (see below) still matches. If it does not, review to see if a Change of Circumstance is needed.

Loan Term

Purpose

Product

Loan Type – Note: FNBA ITIN loans will show Conventional

Loan Amount

Interest Rate

The Rate Lock Agreement disclosure must have already been sent to the borrower

USPS

This document is located in the Property USPS bucket/placeholder in the eFolder

Confirm the full property address is entered correctly in Encompass

County Name must match Encompass

Lock Expiration

The lock must not expire before the good through funding date

If the lock expiration date is close to expiring, email the LO to get it extended

If the cost for the rate lock extension is added on the buyer side, a COC must go out with closing docs

Property Type

Must always match what appraisal says

If it’s marked as a Planned Unit Development (PUD) or Condo on the Appraisal Report, Encompass must reflect the same to generate the correct Rider for your Deed of Trust (DOT)

If property is a Manufactured Home:

Page 2 of the Deed of Trust might need the “Condominium Rider” checkbox unchecked

Manufactured Home Rider and Manufactured Affixation needs to be emailed to Cindy Georgette for Lender Signature and Notarization

FHA Case Number

This document is located in the FHA Case # bucket/placeholder in the eFolder

The case number must be input in the FHA Management screen and include the two dashes and ADP code

If the Case is pulled after application, transfer docs are required

Homeowners Insurance

This document is located in the Property Homeowner Insurance bucket/placeholder in the eFolder

Information on the Homeowners Insurance Policy must match Encompass:

Borrower’s name

Subject property address

Loan number

Mortgagee

If the property requires Flood Insurance, the same info must match

Dwelling Coverage/Coverage A/Replacement Cost Estimator must be equal to or greater than the loan amount

The annual insurance premium (divided by 12 months) must match the monthly payment in Encompass

Property taxes

This document is located in the Tax Bill bucket/placeholder in the eFolder

Ensure the monthly amount matches the Tax Cert./Prelim/Title Report

Mortgage Insurance (MI)/VA Funding Fee/USDA Guarantee Fee

Verify the MI premium is correct.

FHA – Click the “Get MI” button in the Proposed Monthly Payment section.

VA – The VA Funding Fee is determined using the Certificate of Eligibility (COE) and the VA’s Funding Fee Chart.

CONV – Only required if the Loan to Value (LTV) is at or above 80%. Compare the factor against the MI Quote in the eFolder.

ITIN with FNBA – Does not require MI

2nd Lien Position files - Does not require MI

Borrower Information - Vesting

The branch should have completed the Vesting/Manner in which Title will be held. If it is not complete in Encompass, review the Milestone Comments/emails/etc.

Double click each individual buyer and ensure all AKAs from the credit report are input. Note: separate each AKA by inserting a semicolon

Power of Attorney (POA)

For borrowers using a POA, ensure the POA Borrower and POA Signatured Text are complete before clicking the “Build Final Vesting” button

Trust

For borrowers using a trust:

Enter trust type

Add trust date/year

Enter beneficiary info

Click “Print Trust Name(s) on LE/CD Addendum”

Add vesting type, occupancy status, occupancy intent, trustee of and vesting

Texas Properties

For all loans on properties located in Texas, you must enter the “trustee”

Click the magnifying glass then select “Allan B. Polunsky”

Docs Prepared By

Search and select Panorama Mortgage Group

Property Information

Condo/PUD Name – Match the name in Legal Description of Preliminary Title Report

Parcel Number (Note: some new construction might not have one)

Title Report Date

Approved Items (do not include numbers of line items that have a lien)

Tax Message = To be paid

Special Endorsements:

If in Texas enter in T-19

If in Nevada:

100 (newly modified) or 9.10 in lieu of the 100, Alta 9, 8.1, 22‐06

Water rights – 103.5/ALTA 41.1

Condo – 116/ALTA 22‐06

Standard for all states except Nevada:

100, 116, 8.1 ALTA 9

Additionally:

SFR/Duplex – ALTA 9

PUD – 5.1

Condo – 116.2 OR ALTA 4 OR 115.1

Manufactured home – ALTA7

NEG – AM ARM – 6.02

ARM – 111.5

Balloon – 111.9

Water Rights – 103.5

Corporate Assignment – 104.1

Click the "Attach legal description" checkbox

Manufactured - enter all info to match appraisal

2015 Itemization vs the Title Draft CD/Estimated Settlement Statement

Invoices

Ensure the Payee matches Encompass

This is the only screen you are allowed to click the Lock icon and override fees. Often times, an annual fee is divided into monthly payments for qualifying. This can result in the invoiced total being off by a few cents. If we have to pay a total fee upfront, total amount must be accurate.

800. Items Payable in Connection with Loan

Loan Origination Fees – These should match the amount on the last LE.

ITIN w/ FNBA = Should be 3%

Processing Fees – These should match the amount on the last LE.

Underwriting Fees - These should match the amount on the last LE.

Document Preparation Fees - These should match the amount on the last LE.

Origination Points (Discount Points) - Make sure the Bona Fide box is checked.

Verify the Origination Points/Discount Points % matches the Rate Sheet document.

DPAs - Will not have a Rate Sheet

ITINs with FNBA – They issue a “Mortgage Loan Commitment to Purchase.” You DO NOT need to complete this step for these loans.

Line 802e Origination/Discount Point – This number will equal 100 minus the Price on the Rate Sheet. Example … 100 – 96.838 = 3.162

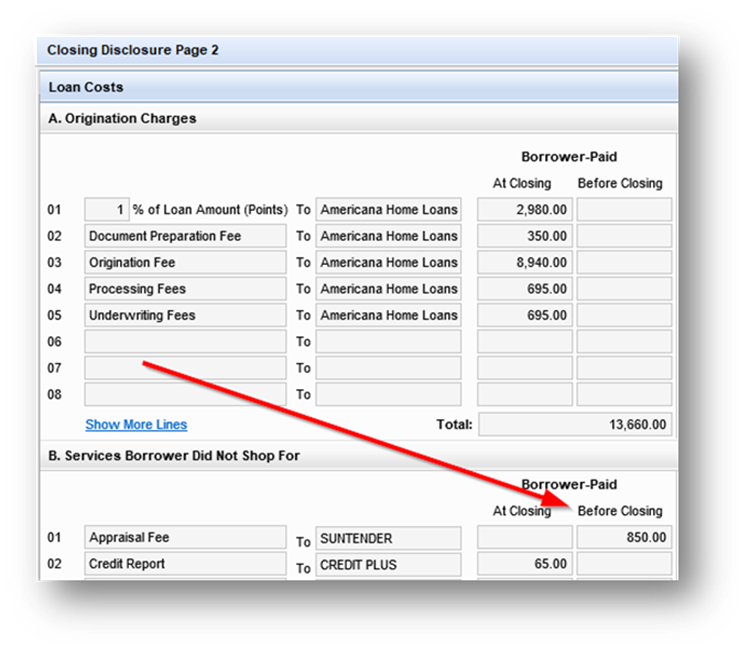

Appraisal Fee – The Invoice should be in the “Invoices” bucket/placeholder. Verify the amount on the Invoice and whether it has been paid already. Open the Fee Details icon next to the Appraisal Fee in Encompass, make sure the total amount matches the total cost and make sure the (POC) Paid Outside of Closing amount matches the amount already paid. Also, make sure the Payee matches. In the example below, Suntender Valuations, Inc. is the Payee.

The amount in Encompass should match the Invoice for these fees:

Credit Report

Verification of Employment

Condo Desk Review Fee

Condo Certification Fee

Reinspection Fee

Do not change the amount of these fees:

Tax Service

Flood Certification

Attorney’s Fee – Texas only

Compliance Review Fee

Recording Fee and Transfer Tax

900. Items Required by Lender to be Paid in Advance

Daily Interest Charges

Make sure this is a positive number. If it’s not, the Est. Closing Date needs to be updated.

Mortgage Insurance Premium

Only required for FHA loans (payee is Department of Housing & Urban Development) and Conventional loan in which the borrower selects to pay the MI up front.

Homeowner’s Insurance (HOI)

Make sure the annual premium on the HOI Invoice is the same as Encompass. If already paid, mark as Paid Outside of Closing (POC).

Property Taxes

If property taxes are due and payable within 60 days of closing, these must be collected upfront.

VA Funding Fee

Only required if it’s a VA loan and the borrower is not exempt from the VA Funding Fee per the Certificate of Eligibility (COE). The payee is Department of Veterans Affairs.

Flood Insurance

If the property is in a Flood Zone and requires Flood Insurance, make sure the annual premium on the Invoice is the same as Encompass. If already paid, mark as Paid Outside of Closing (POC).

1000. Reserves Deposited with Lender

Aggregate Setup

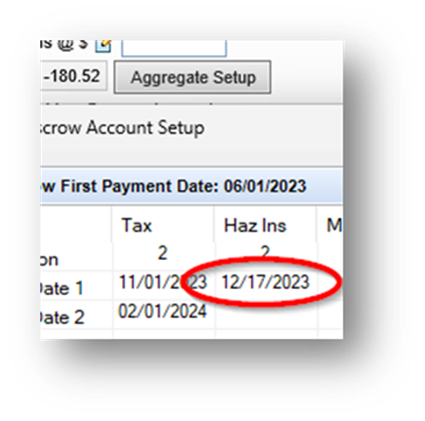

Cushion - Every state except Nevada should have 2 months of Cushion for Property Taxes and Hazard Insurance

Property Tax Due Dates – Reference Tax Cert. or Preliminary Title Report for the upcoming due dates

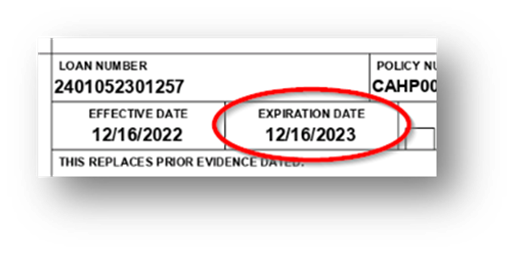

Hazard Insurance - This date should reflect the date after the Expiration Date on the Homeowner’s Insurance Policy Example:

Mortgage Insurance – If the loan requires MI, there needs to be 12 “1’s” starting with the first month after closing

FHA – Will always have MI

Conventional – Only required if LTV is above 80%

USDA – enter 12 1’s under the “annual fee” line with 2 months cushion

Make sure all Paid To boxes show “O” (paid to Other)

1100. Title Charges

All title fees should match the Estimated Settlement Statement/Title Draft CD from Escrow/Title/Settlement Company. If you run out of lines, place the additional fees in Section 1302-1309 (which are indicated with a single asterisk).

Any Prorations should also be entered in Closing Disclosure Page 3

Review the Purchase Contract for the items below. These should also be entered in Closing Disclosure Page 3.

Earned Money Deposit (EMD)

Seller Paid Fees

Compare the settlement company listed on the Settlement Service Provider List (SSPL) initial disclose to the company on the Estimated Settlement Statement/Title Draft CD from Escrow/Title/Settlement Company. If the company name and address are different, place a check in the Borrower Did Shop box next to each fee in Encompass.

1200. Recording Fees

Fees must match the Estimated Settlement Statement/Title Draft CD from Escrow/Title/Settlement Company

1300. Additional Settlement Charges

All “section H” fees per title fee sheet to be entered towards the bottom with the (**)

All fees should be marked as “O” for other here as well

1400. Total Estimated Settlement Charges

If there are any Lender Credits, verify there is written/email approval from management.

Verify any Seller Credit input matches the Purchase Contract. Also, verify the amount of Interested Party Contribution (IPC) does not exceed the program maximum (see chart)

Arizona:

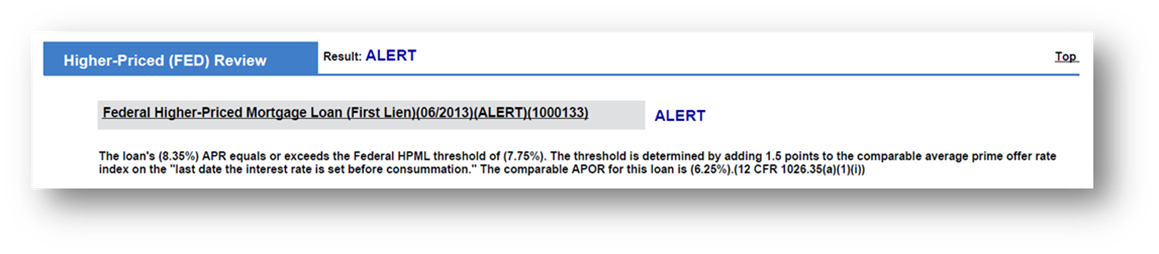

Mavent Report/Compliance Review

Click the Preview button in the top right

Click the Fee Details button

Any red fees need the APR box to be checked/unchecked in the 2015 itemization screen

Review for Alerts, Warnings or Fails

If any of these Alerts show, check the RateSheet in the eFolder and find the “Waive Escrows” info. If this says “No” we are okay to proceed without clearing these Alerts.

If ITIN with FNBA, it doesn’t have to pass the QM Points and Fees Limit

If the Loan Program is FHA, it does not have to pass this test:

If this Warning appears, you can ignore them and keep going

QM Points and Fees Test

The % in the “Total points and fees applicable under section 32” should be lower than the % above it in the “Current Qualified Mortgage Fee Thresholder” field. If it’s not, notify your manager.

Closing Disclosures Page 1

Review the Disclosure Information section to see if a Change of Circumstance (COC) needs to be sent out with the Closing Docs

File # = Preliminary Title Report/Order/File Number

Make sure both "Customize" boxes are NOT checked

Closing Disclosure Page 2

Fees should be marked paid “Before Closing” only if we have an Invoice showing the fee has already been paid

Closing Disclosure Page 3

See details in

For Purchases, update the drop-down to show "Section K and Section L"

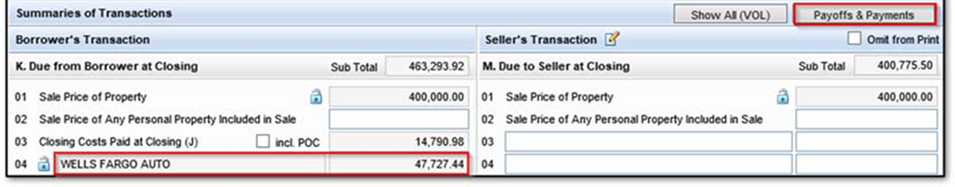

Payoffs & Payments

Any accounts being paid off must have a Payoff Statement, Account Printout or Credit Supplement.

Amounts must match between the document and Encompass.

If you have payoffs for a purchase and your top/bottom amounts don’t match – copy your payoff amount, click the pen and paper then add under “Non‐UCD”

The Cash to Close total and the Cash From/To Borrower must match

Closing Disclosure Page 4

Assumption

For FHA and VA loans, the “will allow, under certain conditions, this person to assume this loan on the original terms” checkbox should be checked. For Conventional, check the other box.

Check the “does not have a demand feature” checkbox and the “Get Late Fee” button.

The “do not have a negative amortization feature” and “does not accept any partial payments” boxes should be checked.

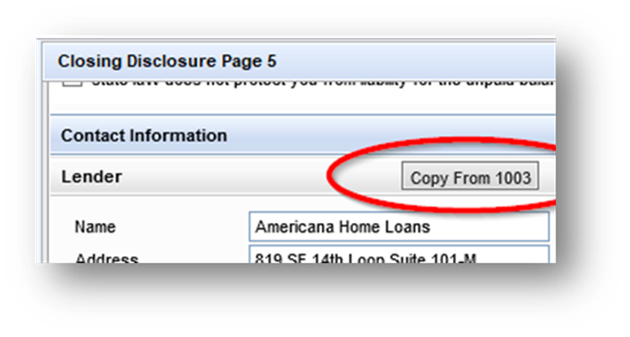

Closing Disclosure Page 5

Other Disclosures – Check “state law may protect you from liability for the unpaid balance”

In the “Lender” section click the “Copy from 1003” button

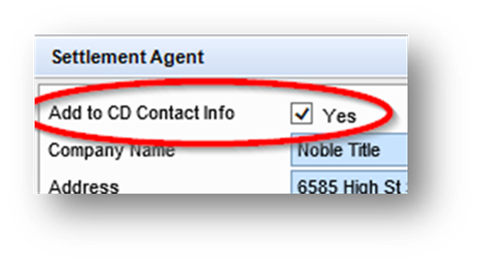

For Purchases, the Real Estate Broker (Buyer/Seller) should have all fields except the NMLS field completed (if not, navigate to the File Contacts and click “Add to CD Contact Info”)

Settlement Agent should be completed with license numbers (if not, navigate to the File Contacts and click “Add to CD Contact Info”)

Send the Closing Docs

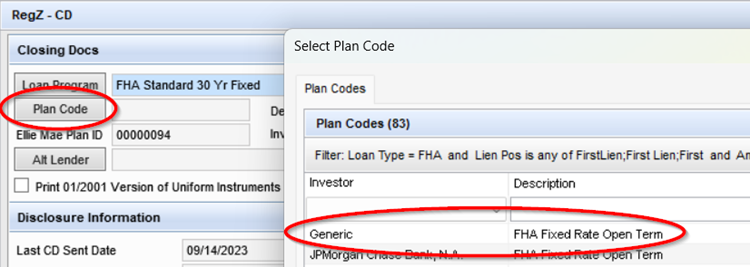

Navigate to the RegZ – CD screen.

Click the Plan Code button and choose the top option in the pop-up window.

Signing/Note Date

The fields below should all reflect the date the borrower will be signing:

CD Date Issued

Document Date

Closing Date

Doc Signing Date

The fields below should all reflect the date the loan will be funded:

Disbursement Date

Confirm your MERS MIN # has populated (excludes ITIN loans)

Confirm your first payment date is correct

Generate the Closing Docs

Click the Order Docs button

If you get any of these pop-ups, click OK and close them

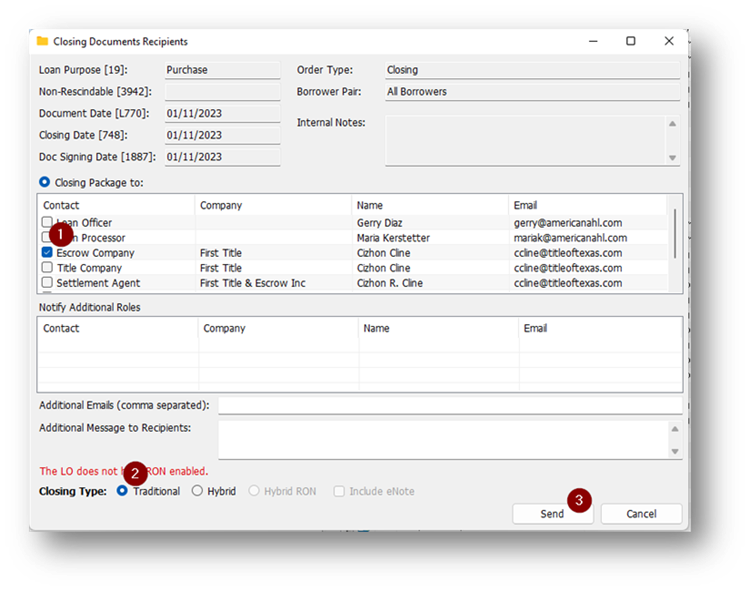

Make sure the “Order Type” says “Closing” and click the “Order Docs” button

Add Additional Documents

Click the “Add eFolder Files” radio button and select “All” from the “For Borrower Pair” drop-down

Select all the buckets/placeholders below. Note, some files might not have some from the list:

Assets: Gift Letters

Closing Invoices

DPA docs (if applicable)

Homeowners Insurance

Invoices

Payoff Statements

Property: Flood Insurance

Property: Sales Contract

Property: Homeowner’s Insurance Policy

Purchase: Purchase Contract

To be signed

Click the “Add” button

Click the “Send” button

Click Send, click “Send through Simple Nexus,” select the Escrow contact, click the “Traditional” radio button and click Send.

Send email notify Escrow/Settlement Company that Closing Docs have been sent.

Mark the Finished checkbox in the Doc Prep milestone worksheet.

Assign the Funder.