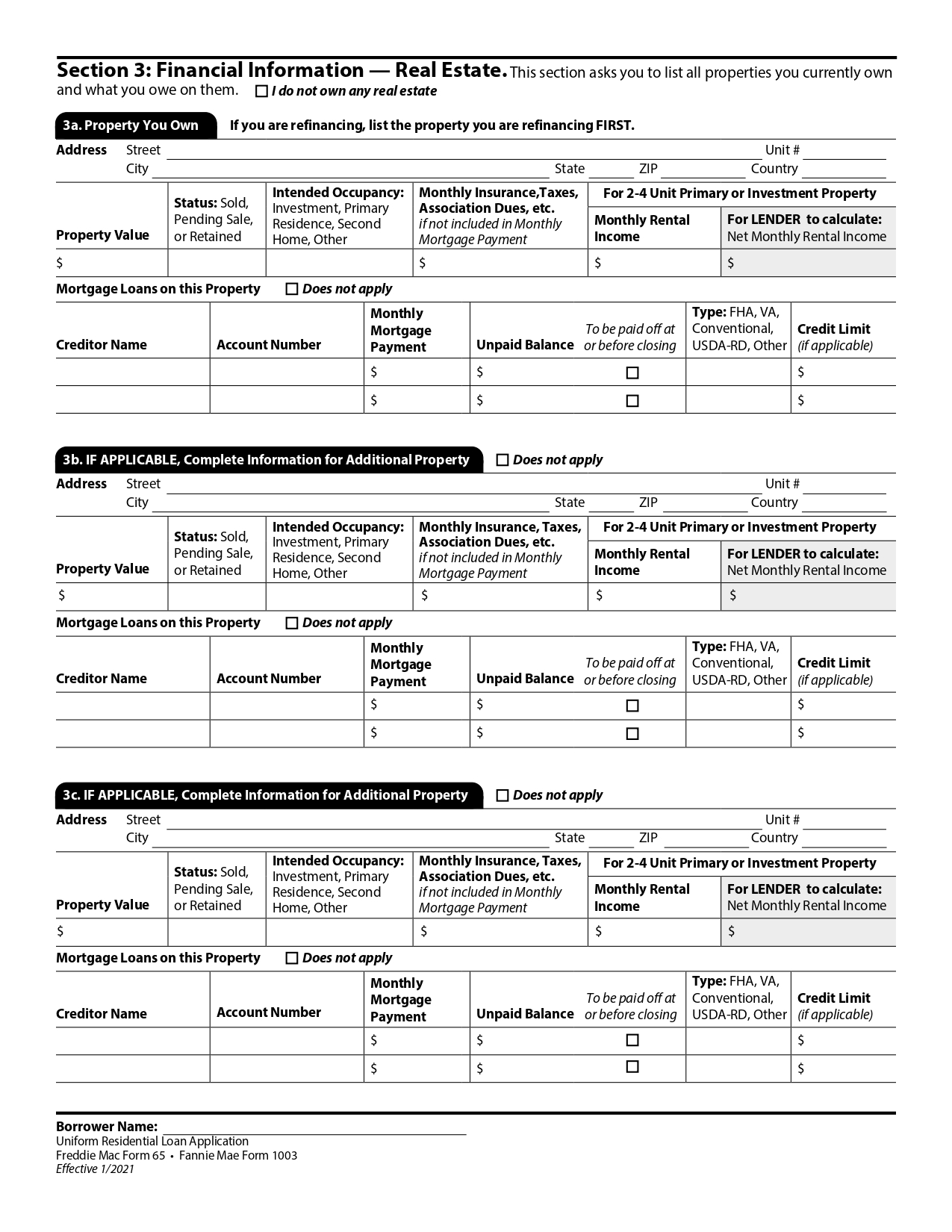

Module 4: Section 3 - Financial Information - Real Estate

This section lists the borrower's real estate they own. In each section, the applicant must fill out the following, if applicable:

If this is refinance transaction, list the property they are refinancing first.

Enter the associated mortgage(s) details for each property (including undeveloped land) if they are obligated on a mortgage, no matter what their relationship is to the property—whether they own the property by themself, jointly with someone else, or are not on the title to the property.

Select “I do not own any real estate” and skip to Section 4a. Loan and Property Information if they do not own real property and are not obligated on a mortgage.

Property Value

Provide an estimate of the current property value.

Status

▪ Enter Sold if they recently sold the property.

▪ Enter Pending Sale if the property is currently under contract for sale and they plan to sell it before they close on this mortgage loan.

▪ Enter Retained if:

the subject loan is a refinance,

they will continue to own the property after this mortgage loan closes (for example, if the property is a vacation home or investment property that is not the subject of the mortgage loan), OR

the property is currently listed for sale but is not under contract yet.

Intended Occupancy

If they will continue to own the property after closing, provide its intended use:

▪ Enter Investment if neither they nor any other Borrower on the subject transaction intends to occupy the property.

▪ Enter Primary Residence if

They intend to occupy the property as their primary residence, OR

the mortgage loan meets the requirements for Primary Residence eligibility.

▪ Enter Second Home if they or any Borrower intend to occupy the property but not as their primary residence (for example, as a vacation home).

▪ Enter Other if none of the other intended uses applies (for example, if the property is undeveloped land) or if they do not know if or how they will occupy the property.

Monthly Insurance, Taxes, Association Dues, etc.

▪ Enter the sum of any of these expenses that are not included in the amount entered for Monthly Mortgage Payment under Mortgage Loans on this Property.

▪ Association dues (condo, PUD, co-op fees, or special assessments) are not generally included in a monthly mortgage payment and therefore should be entered here.

Monthly Rental Income

If owned Retained property is a 2-4 unit primary residence or an investment property, enter the gross monthly rental income they receive from the property.

Net Monthly Rental Income

Calculate using a Rental Income Worksheet

Mortgage Loans on this Property

Select “Does not apply” and skip to Section 4a. Loan and Property Information if you are not obligated on a mortgage for this property.

Monthly Mortgage Payment

Enter the mortgage payment amount. Include the cost of insurance and taxes in this amount if you did not enter them separately under Monthly Insurance, Taxes, Association Dues, etc.

Unpaid Balance To be paid off at or before closing

▪ Enter the balance due on the mortgage loan. You can obtain this amount from your credit report or other document, such as the mortgage statement

▪ Select “To be paid off at or before closing” for any mortgage loans that will be paid off at or before closing.

Credit Limit

Enter the maximum amount that they are permitted to borrow if they have a home equity line of credit on the property.