Processing LE Change of Circumstance

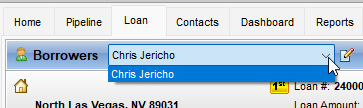

Verify how many Borrowers and Borrower Pairs need to be disclosed.

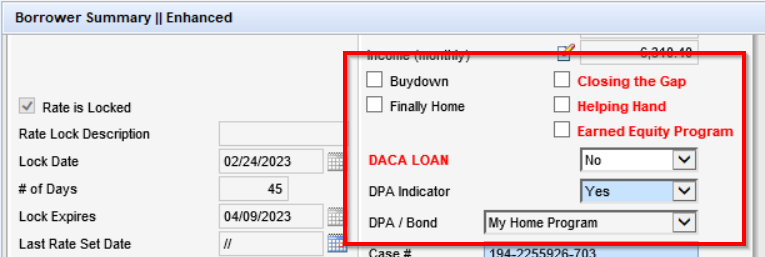

Check what type of Loan Program we are using in the “Borrower Summary II Enhanced” screen. In addition to the “Loan Program” field, check the indicator boxes.

Check to see if there is subordinate financing. If there is, you will need to send a Revised LE/COC for both files.

If the loan program name has “DPA” in it, there’s subordinate financing

Check the VOAL screen, if there is a lien/file, there’s subordinate financing

If the LTV/CLTV/HCLTV are different numbers, there’s subordinate financing

Loan Estimate Page 1

Review the Changed Circumstance and Comments to make sure all the appropriate Reasons are checked.

If this is selected…

Additional service (such as survey) is necessary based on title report

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Appraised value is different than estimated value

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Borrower income could not be verified or was verified at different amount

Then this Reason should be checked…

Changed Circumstance - Eligibility

If this is selected…

Borrower request change

Then this Reason should be checked…

If this is selected, notify your manager

If this is selected…

Change in loan amount

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Change in PMI, UFMIP, VA Funding Fee or USDA Guarantee Fee

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Change in purchase price

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Final Inspection (1004D) Required

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

If this is selected…

Loan type or loan program has changed

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Locked Loan

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Other

Then this Reason should be checked…

If this is selected, notify your manager

If this is selected…

Pricing Change

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Rate lock extension

Then this Reason should be checked…

Change in APR

Change in Settlement Charges

Interest Rate dependent charges (Rate Lock)

If this is selected…

Recording fee are increased based on need to record additional unanticipated documents such as release of prior lien

Then this Reason should be checked…

Change in Settlement Charges

Alerts & Messages

See if there is a “Good Faith Fee Variance” flag. The Changed Circumstance/Comment/Reason in the “Loan Estimate Page 1” form should correspond with any variance. If they do not, review these with your manager.

If there are any Cost to Cures, make a note in the Milestone Comments as to what caused the Cost to Cure

Click on eFolder

Click on eDisclosures

Click on Continue

Select the correct borrower, if more than one.

Then click Order eDisclosures.