Pay Stubs Guide

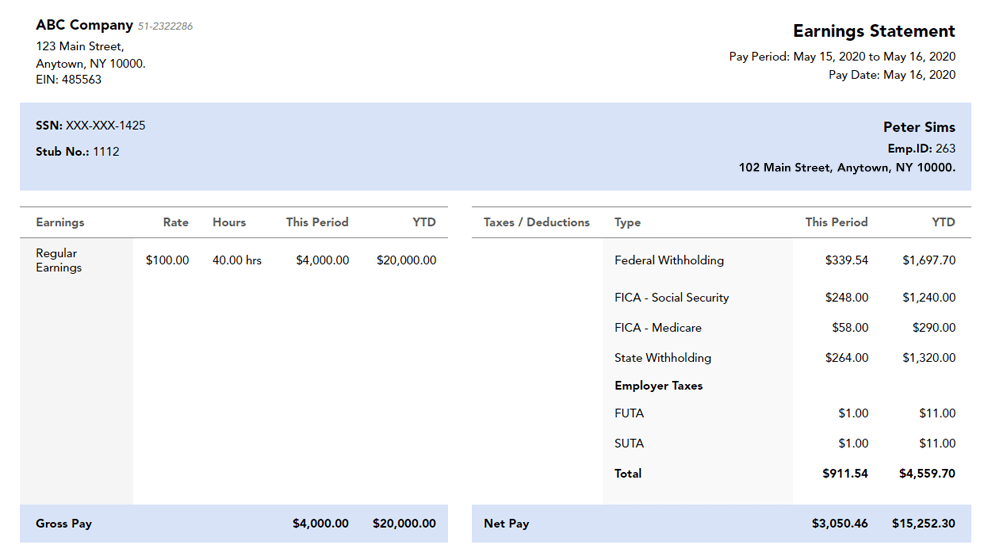

Pay stubs, also known as paycheck stubs, are documents that provide detailed information about an employee's earnings and deductions for a specific pay period. They serve as a record of the employee's wages and are typically issued with each paycheck.

When reviewing a pay stub, keep in mind the following steps:

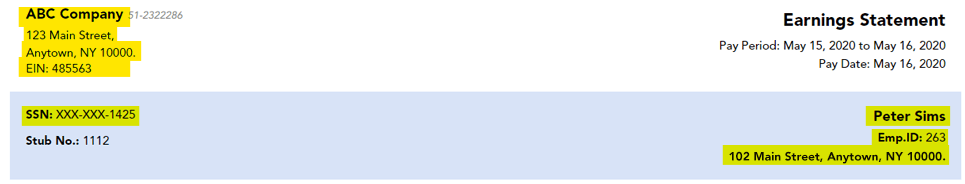

Identify the employee and employer information. This is typically at the top of the paystub. Keep in mind the following:

Employer name should be the same as the one on file.

Employer address might differ from the address on file, due to pay stubs being issued from corporate office, while the employer address on file will represent the actual address where the employee works at.

Employee name must match the borrower’s ID.

Review the pay period. In some pay stubs, the pay period is shown as the Period Start and Period End dates. Do not confuse the Pay Date with the Period End date. The Period End date represents the last day accounted for wages per that pay stub, while the Pay Date is the actual date that the pay stub is issued.

Verify the hourly rate. Multiply the hourly rate by the hours worked and confirm that the result matches the pay period total gross earnings.

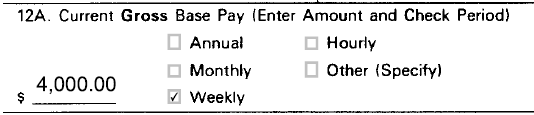

Verify the gross period earnings against the income described in the Written Verification of Employment (WVOE). Convert the pay stub earnings to the pay period in the WVOE and confirm that the numbers match the WVOE Part II §12A.

Verify the gross YTD earnings. Calculate the number of months (and decimals) that have passed between the start of the year and the Period End date. Your Income Calculation Worksheet allows you to do this by typing in the Period End date in the YTD calculation area.

Then, convert the pay stub earnings to the monthly income amount and multiply it by the number of months (and decimals) that have passed between the start of the year and the Period End date.

Then, convert the pay stub earnings to the monthly income amount and multiply it by the number of months (and decimals) that have passed between the start of the year and the Period End date.

If the amount doesn’t match the YTD earnings, the discrepancy must be addressed through a letter of explanation from the employer. Discrepancies in earnings can happen due to hiring dates, vacation, unpaid leave, etc.

If the amount doesn’t match the YTD earnings, the discrepancy must be addressed through a letter of explanation from the employer. Discrepancies in earnings can happen due to hiring dates, vacation, unpaid leave, etc.

Review the deductions. Court mandated deductions showing up as Judgement, Child Support, Alimony, etc. are possible liabilities that must be addressed and explained.