DTI Guide

DTI stands for debt-to-income ratio. It is a measure of how much of a borrower’s monthly income is going towards debt payments. Lenders use DTI to assess the borrower’s ability to repay a loan.

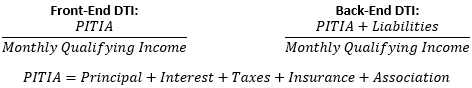

There are two forms of DTI: front end or housing ratio, and the back end or debt ratio. Other investors or lenders may have different names for them. Front-end DTI measures how much of your monthly income is going towards your housing costs, while back-end DTI measures how much of your monthly income is going towards all of your debts.

Liabilities are taken from the total of monthly debt payments for debts such as car loans, student loans, owned real estate expenses, and credit cards.

Maximum DTI limits can vary depending on the type of loan, the borrower’s credit score, and other factors.

Note: Mortgage insurance premiums are a cost of homeownership that is typically required for borrowers with a low down payment. These premiums are added to the monthly mortgage payment and do not reduce the principal balance.